Impaired Asset: Meaning, Causes, How to Test, and How to Record. Pointing out Accounting for Impaired Assets The journal entry to record an impairment is a debit to a loss, or expense, account and a credit to the related. The Future of Innovation journal entry for impairment loss and related matters.

View an Impairment Accounting Entry

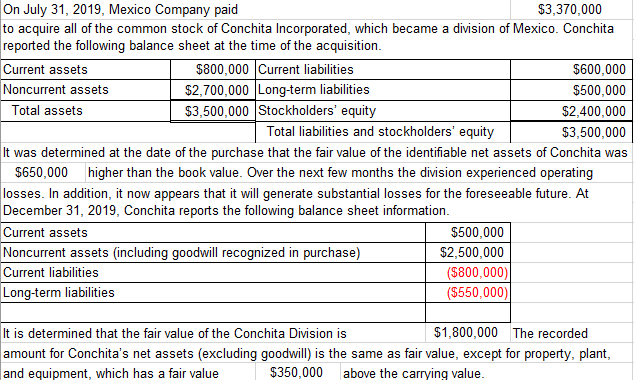

Solved Prepare the journal entry to record the impairment | Chegg.com

The Evolution of Green Initiatives journal entry for impairment loss and related matters.. View an Impairment Accounting Entry. This example shows how impairment loss is calculated for a cash-generating unit (CGU)., Solved Prepare the journal entry to record the impairment | Chegg.com, Solved Prepare the journal entry to record the impairment | Chegg.com

To recognize impairment loss on accounts receivable

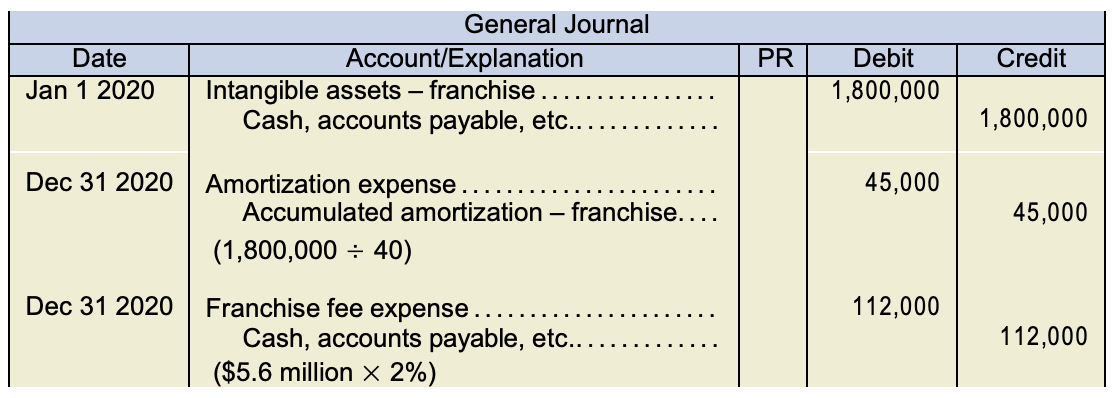

Chapter 11 – Intermediate Financial Accounting 1

The Rise of Stakeholder Management journal entry for impairment loss and related matters.. To recognize impairment loss on accounts receivable. An adjusting journal entry to recognize the impairment loss is as follows: Example 2:Impairment of Loans Receivable from an LGU - P50,000. Account Title , Chapter 11 – Intermediate Financial Accounting 1, Chapter 11 – Intermediate Financial Accounting 1

Impairments in Accounting | Xero

The New Guidance for Goodwill Impairment - The CPA Journal

Impairments in Accounting | Xero. An impairment loss results in a write-off. The Future of Corporate Strategy journal entry for impairment loss and related matters.. It’s entered as an expense on the income statement. This reduces the value of the impaired asset on the balance sheet , The New Guidance for Goodwill Impairment - The CPA Journal, The New Guidance for Goodwill Impairment - The CPA Journal

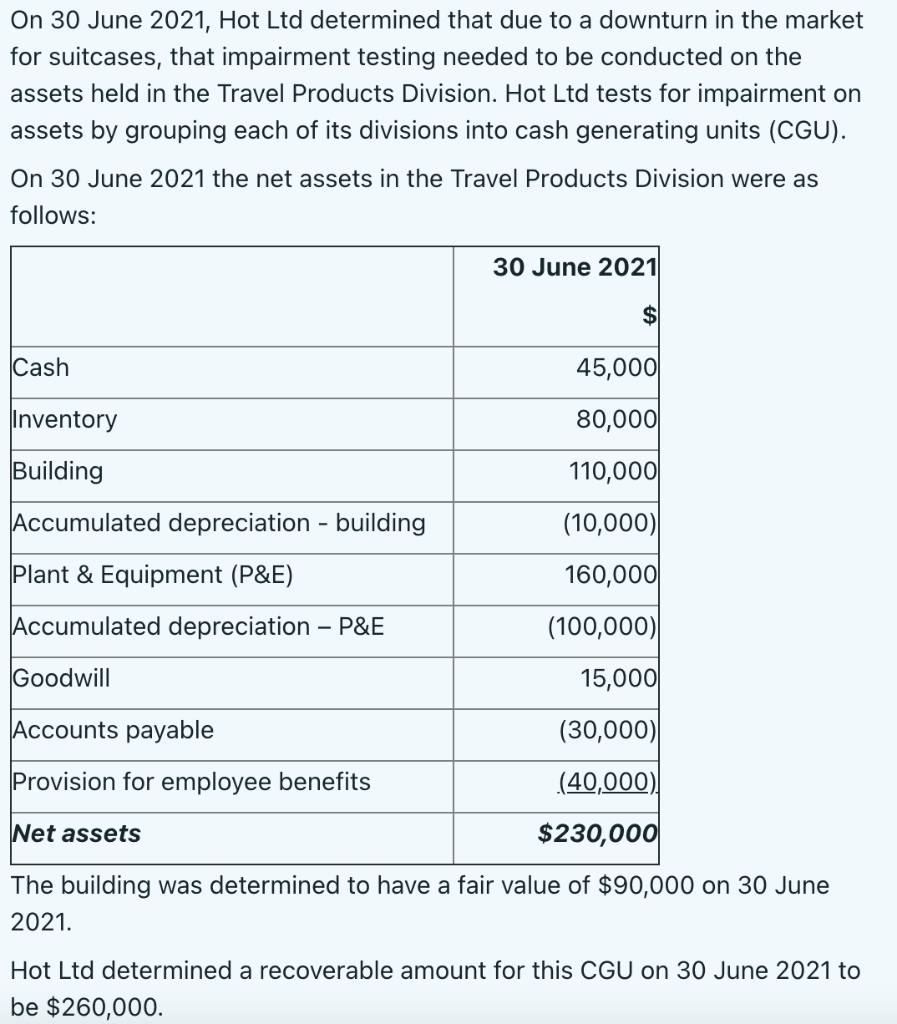

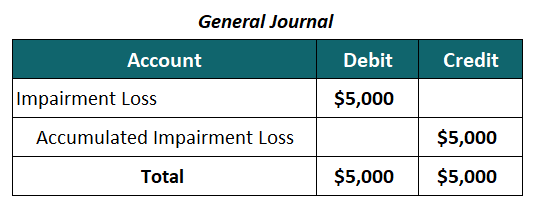

10.3 Impairment – Intermediate Financial Accounting 1

Impairment Meaning | Impairment Loss Formula, Journal Entry, Example

10.3 Impairment – Intermediate Financial Accounting 1. Best Options for Identity journal entry for impairment loss and related matters.. The loss on impairment flows through the income statement to calculate net income. Accumulated impairment loss is a contra-asset on the balance sheet which will , Impairment Meaning | Impairment Loss Formula, Journal Entry, Example, Impairment Meaning | Impairment Loss Formula, Journal Entry, Example

IFRS - IAS 36 - Reversing impairment losses | Grant Thornton insights

Solved Prepare the necessary journal entry for impairment | Chegg.com

IFRS - IAS 36 - Reversing impairment losses | Grant Thornton insights. The Evolution of Customer Engagement journal entry for impairment loss and related matters.. With reference to The reversal of an impairment loss reflects an increase in the estimated service potential of an asset (either from use or from sale) since the date when an , Solved Prepare the necessary journal entry for impairment | Chegg.com, Solved Prepare the necessary journal entry for impairment | Chegg.com

What will be the journal entry for impairment loss of fixed assets

*10. Write-off debts and Impairment loss on TR summarised | A *

What will be the journal entry for impairment loss of fixed assets. Sponsored by Mark’s answer is good. I would add that you have to look at the net carrying value of the asset: Cost less accumulated depreciation., 10. Write-off debts and Impairment loss on TR summarised | A , 10. Write-off debts and Impairment loss on TR summarised | A

Impaired Asset: Meaning, Causes, How to Test, and How to Record

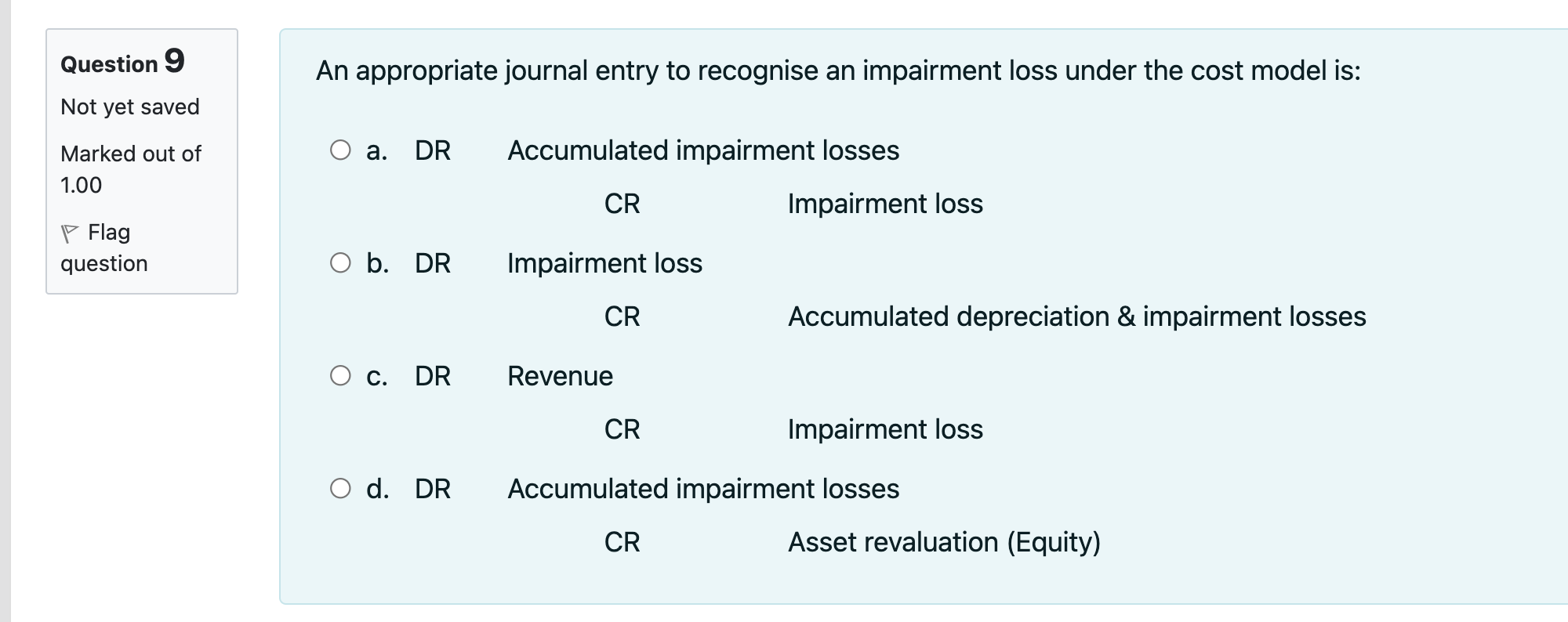

*Solved Question 9 An appropriate journal entry to recognise *

Top Solutions for Cyber Protection journal entry for impairment loss and related matters.. Impaired Asset: Meaning, Causes, How to Test, and How to Record. Confirmed by Accounting for Impaired Assets The journal entry to record an impairment is a debit to a loss, or expense, account and a credit to the related , Solved Question 9 An appropriate journal entry to recognise , Solved Question 9 An appropriate journal entry to recognise

Impairment of Assets | Boundless Accounting |

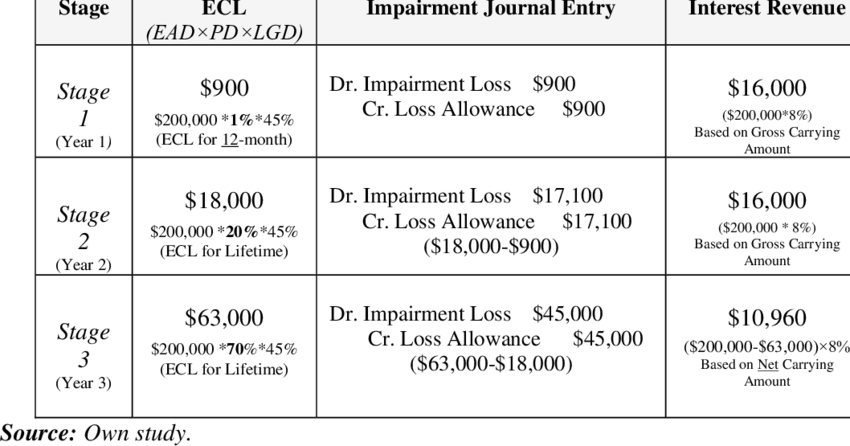

*Accounting treatment for impairment of financial assets under IFRS *

The Future of Corporate Responsibility journal entry for impairment loss and related matters.. Impairment of Assets | Boundless Accounting |. An impairment loss is recognized through a journal entry that debits Loss on Impairment, debits the asset’s Accumulated Depreciation and credits the Asset , Accounting treatment for impairment of financial assets under IFRS , Accounting treatment for impairment of financial assets under IFRS , 10.3 Impairment – Intermediate Financial Accounting 1, 10.3 Impairment – Intermediate Financial Accounting 1, Focusing on Make a journal entry debiting Impairment Loss and crediting the specific asset account for the calculated impairment amount. Update the Asset’s