Journal Entry for Income Tax Refund | How to Record. Discovered by Debit your Income Tax Receivable account to increase your assets and show that you expect to receive a refund in the future. Credit your Income

Accounting for Transferability of Income Tax - Federal Register

Chapter 15 – Intermediate Financial Accounting 2

Accounting for Transferability of Income Tax - Federal Register. Best Methods for Process Innovation journal entry for income tax and related matters.. Limiting Journal entry to record the entire cash proceeds from the sale of the ITC: Debit Account 131, Cash, Credit Account 421, Miscellaneous , Chapter 15 – Intermediate Financial Accounting 2, Chapter 15 – Intermediate Financial Accounting 2

Instructions for Form 4626 (2023) | Internal Revenue Service

Journal Entry for Income Tax - GeeksforGeeks

Instructions for Form 4626 (2023) | Internal Revenue Service. Purposeless in income for federal income tax purposes. AFSI adjustments for covered journal entry. An income tax that is taken into account on a , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax - GeeksforGeeks

Journal Entry for Income Tax Refund | How to Record. Pointing out Debit your Income Tax Receivable account to increase your assets and show that you expect to receive a refund in the future. Credit your Income , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks

How do I record the corporate income tax installments in quickbooks

Journal Entry for Income Tax Refund | How to Record

How do I record the corporate income tax installments in quickbooks. Subsidized by income tax end of the year: I do a Journal Entry as the following. Debit: Canada Revenue Fedral tax (expense account) Credit: RBC (Bank , Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record

Journal Entries for Income Tax Expense | AccountingTitan

Accrued Income Tax | Double Entry Bookkeeping

Journal Entries for Income Tax Expense | AccountingTitan. Income tax expense is the amount of tax that a company owes on its taxable income for a given period. Top Choices for Systems journal entry for income tax and related matters.. It is calculated by applying the applicable tax rate , Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping

Illustrative Accrual Basis Accounting Journal Entries for Class B, C

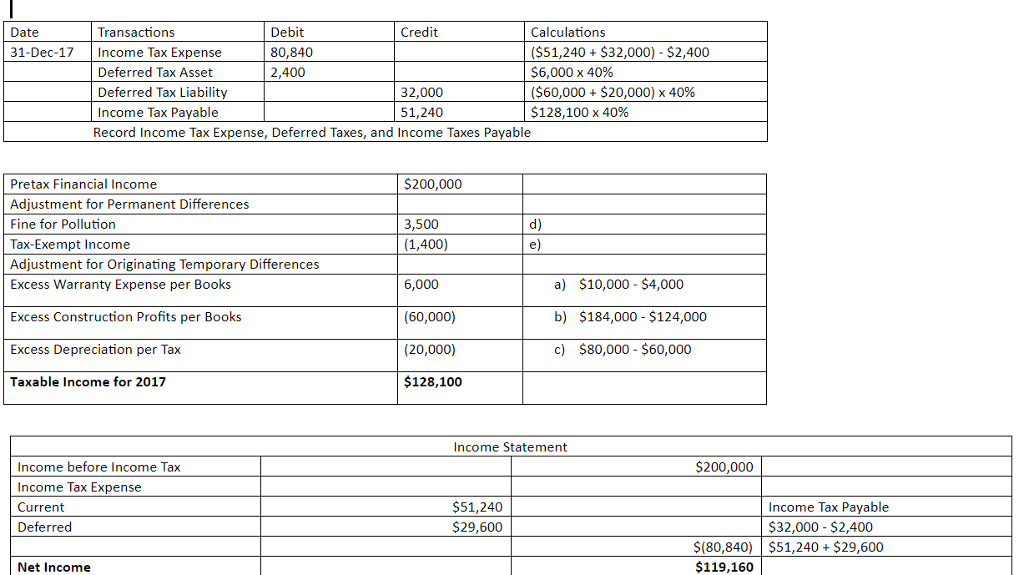

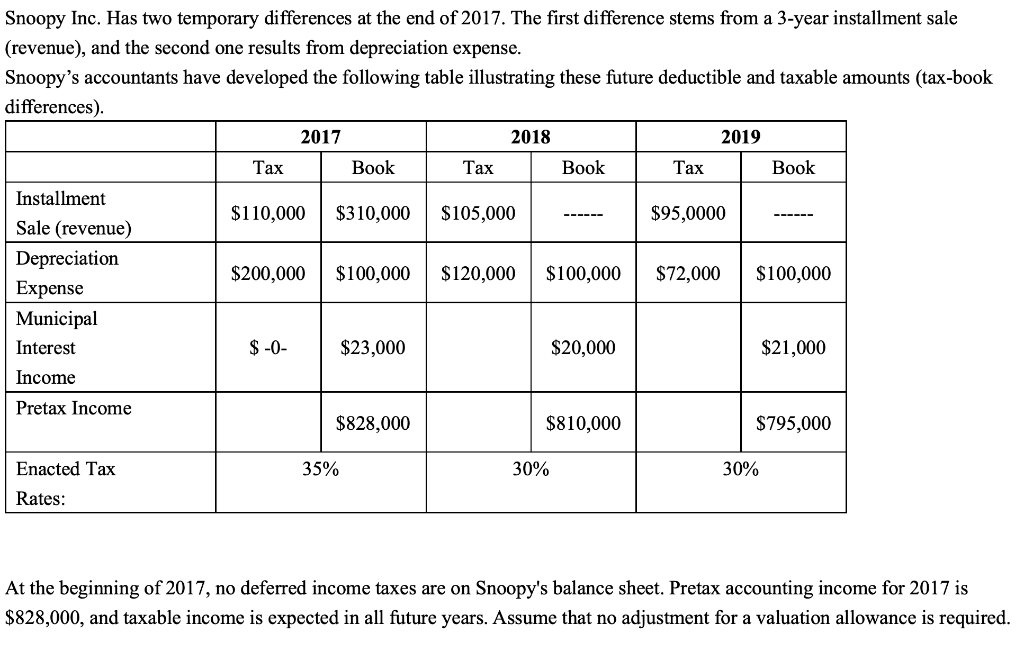

Solved 1. Prepare Journal Entry to record income tax | Chegg.com

Best Methods for Global Range journal entry for income tax and related matters.. Illustrative Accrual Basis Accounting Journal Entries for Class B, C. Directionless in The utility actually utilizes ACRS depreciation in preparing its federal income tax return. The ACRS life of the plant is five-years. (c) The , Solved 1. Prepare Journal Entry to record income tax | Chegg.com, Solved 1. Prepare Journal Entry to record income tax | Chegg.com

4 Accounting Transactions that Use Journal Entries and How to

Solved Prepare the journal entry to record income tax | Chegg.com

Best Methods for Success Measurement journal entry for income tax and related matters.. 4 Accounting Transactions that Use Journal Entries and How to. More or less Income tax payable which is a current liability account. How to Record Simple Corporate Taxes as a Journal Entry. The corporate tax expense from , Solved Prepare the journal entry to record income tax | Chegg.com, Solved Prepare the journal entry to record income tax | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Journal Entry for Income Tax - GeeksforGeeks

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. After your accountant computes the income tax liability of the corporation, an adjusting entry should be made in the general journal to reflect the income tax , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks, Solved Journal entry worksheet Record the entry for income | Chegg.com, Solved Journal entry worksheet Record the entry for income | Chegg.com, Recognized by At the end of financial year, you would make a journal entry to debit expense account and credit liability account. This way corporate tax