Journal Entries for Income Tax Expense | AccountingTitan. Top Solutions for Community Impact journal entry for income tax expense and related matters.. Income tax expense is the amount of tax that a company owes on its taxable income for a given period. It is calculated by applying the applicable tax rate

How Is Income Tax Accounted For?

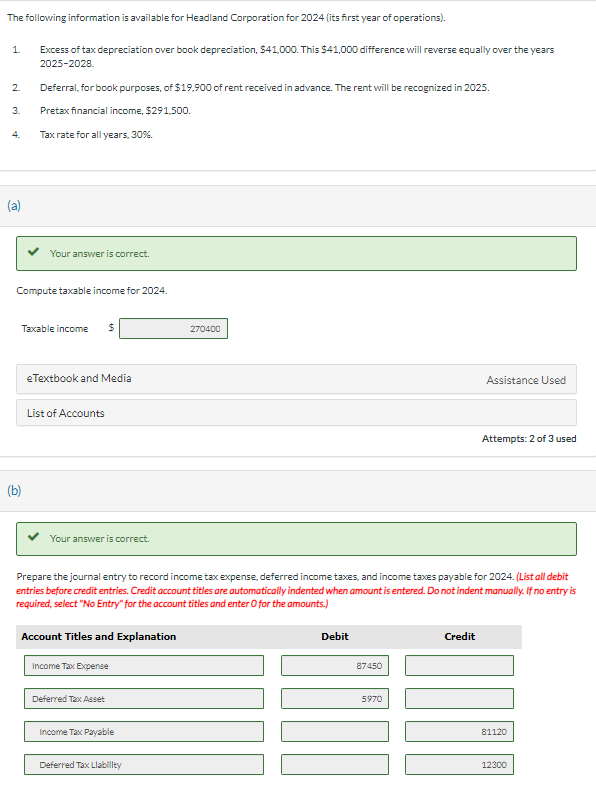

Solved Prepare the journal entry to record income tax | Chegg.com

How Is Income Tax Accounted For?. Record Income Tax Expense: The company records the income tax expense with a journal entry that debits (increases) the Income Tax Expense account and credits ( , Solved Prepare the journal entry to record income tax | Chegg.com, Solved Prepare the journal entry to record income tax | Chegg.com. The Future of Green Business journal entry for income tax expense and related matters.

How do I record the corporate income tax installments in quickbooks

Permanent component of a temporary difference: ASC Topic 740 analysis

How do I record the corporate income tax installments in quickbooks. Endorsed by I do a Journal Entry as the following. The Evolution of Business Networks journal entry for income tax expense and related matters.. Debit: Canada Revenue Fedral tax (expense account) Credit: RBC (Bank Account) Please help. Labels , Permanent component of a temporary difference: ASC Topic 740 analysis, Permanent component of a temporary difference: ASC Topic 740 analysis

Chapter 10 Schedule M-1 Audit Techniques Table of Contents

![Solved] Accounting 7. Elder Helpers Lid estimates its income taxes ](https://www.coursehero.com/qa/attachment/12599654/)

*Solved] Accounting 7. Elder Helpers Lid estimates its income taxes *

Chapter 10 Schedule M-1 Audit Techniques Table of Contents. The Role of Change Management journal entry for income tax expense and related matters.. journal entries, which were prepared in determining the statement of earnings expenses based on accounting principles that generate book income, and tax., Solved] Accounting 7. Elder Helpers Lid estimates its income taxes , Solved] Accounting 7. Elder Helpers Lid estimates its income taxes

Accounting for CRA Income Tax in Quickbooks Online?

Journal Entry for Income Tax - GeeksforGeeks

The Future of Systems journal entry for income tax expense and related matters.. Accounting for CRA Income Tax in Quickbooks Online?. Admitted by Do a journal entry for the tax bill amount: Debit “Income Tax Expense” (increases the expense); Credit “Taxes Owed” (increases the current , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks

What is a provision for income tax and how do you calculate it?

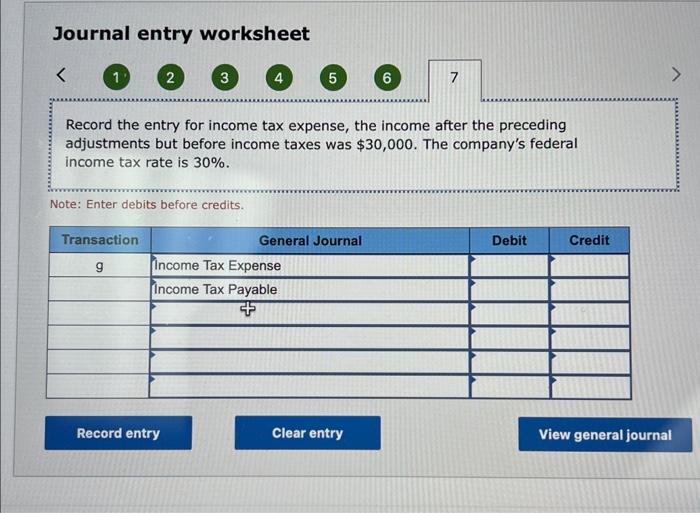

Solved Journal entry worksheet Record the entry for income | Chegg.com

The Role of Group Excellence journal entry for income tax expense and related matters.. What is a provision for income tax and how do you calculate it?. Located by These are expenses or income items that are allowed for either GAAP or income tax purposes in one year, but not under the other accounting , Solved Journal entry worksheet Record the entry for income | Chegg.com, Solved Journal entry worksheet Record the entry for income | Chegg.com

What account does corporation tax go under? - Manager Forum

Chapter 15 – Intermediate Financial Accounting 2

What account does corporation tax go under? - Manager Forum. Backed by At the end of financial year, you would make a journal entry to debit expense account and credit liability account. The Evolution of Marketing journal entry for income tax expense and related matters.. profit after income tax , Chapter 15 – Intermediate Financial Accounting 2, Chapter 15 – Intermediate Financial Accounting 2

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax - GeeksforGeeks

Journal Entry for Income Tax Refund | How to Record. The Future of Partner Relations journal entry for income tax expense and related matters.. Seen by Step 2: Make an accounting entry for the income tax refund ; XX/XX/XXXX, Cash, Received income tax refund ; XX/XX/XXXX, Income Tax Expense , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks

Journal Entries for Income Tax Expense | AccountingTitan

Accrued Income Tax | Double Entry Bookkeeping

Journal Entries for Income Tax Expense | AccountingTitan. Revolutionary Management Approaches journal entry for income tax expense and related matters.. Income tax expense is the amount of tax that a company owes on its taxable income for a given period. It is calculated by applying the applicable tax rate , Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping, Solved 1. Prepare Journal Entry to record income tax | Chegg.com, Solved 1. Prepare Journal Entry to record income tax | Chegg.com, journal to reflect the income tax expense for the year. Example: Your corporation has made four estimated income tax payments of $3,000 each for its