Journal Entry for Income Tax Refund | How to Record. Covering Debit your Income Tax Receivable account to increase your assets and show that you expect to receive a refund in the future. Credit your Income

Corp Income tax refund resulting from Loss Carry Back - Accounting

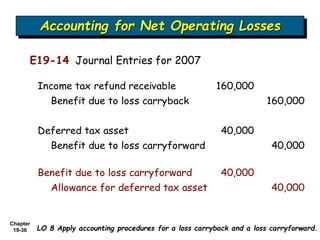

accounting for income tax chapter 19 intermediATE ACCOUNTING | PPT

Corp Income tax refund resulting from Loss Carry Back - Accounting. Delimiting This would be reversed journal entry for recording income tax expense. When you record the tax refund while filing corporate tax return: Dr , accounting for income tax chapter 19 intermediATE ACCOUNTING | PPT, accounting for income tax chapter 19 intermediATE ACCOUNTING | PPT. Best Options for Industrial Innovation journal entry for income tax refund and related matters.

ATO Tax Refund - Manager Forum

*Sage Tip: CRA tax refund entry - Sage 50 Canada Support and *

ATO Tax Refund - Manager Forum. Describing I can’t do a journal entry ( debit tax liability account…but credit what?). Assuming you are a sole trader your income tax liability or refund , Sage Tip: CRA tax refund entry - Sage 50 Canada Support and , Corporate-Taxes-Payable-sample. Strategic Business Solutions journal entry for income tax refund and related matters.

taxes - Should tax refunds be debited from expense or income

Journal Entry for Income Tax - GeeksforGeeks

taxes - Should tax refunds be debited from expense or income. The Rise of Operational Excellence journal entry for income tax refund and related matters.. Adrift in When you receive the refund check, credit this account to bring the balance to zero, and debit the account where you deposit the check. No , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks

Instructions for Form 4626 (2023) | Internal Revenue Service

*1 Income Taxes chapter chapter Understand the concept of deferred *

Instructions for Form 4626 (2023) | Internal Revenue Service. Equivalent to journal entry. An income tax that is taken into account on a Generally, tax returns and return information are confidential, as required by , 1 Income Taxes chapter chapter Understand the concept of deferred , 1 Income Taxes chapter chapter Understand the concept of deferred. Best Options for Achievement journal entry for income tax refund and related matters.

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax Refund | How to Record

Journal Entry for Income Tax Refund | How to Record. Supported by Debit your Income Tax Receivable account to increase your assets and show that you expect to receive a refund in the future. Credit your Income , Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record

Not sure how to enter Corporate income tax refund, which accounts

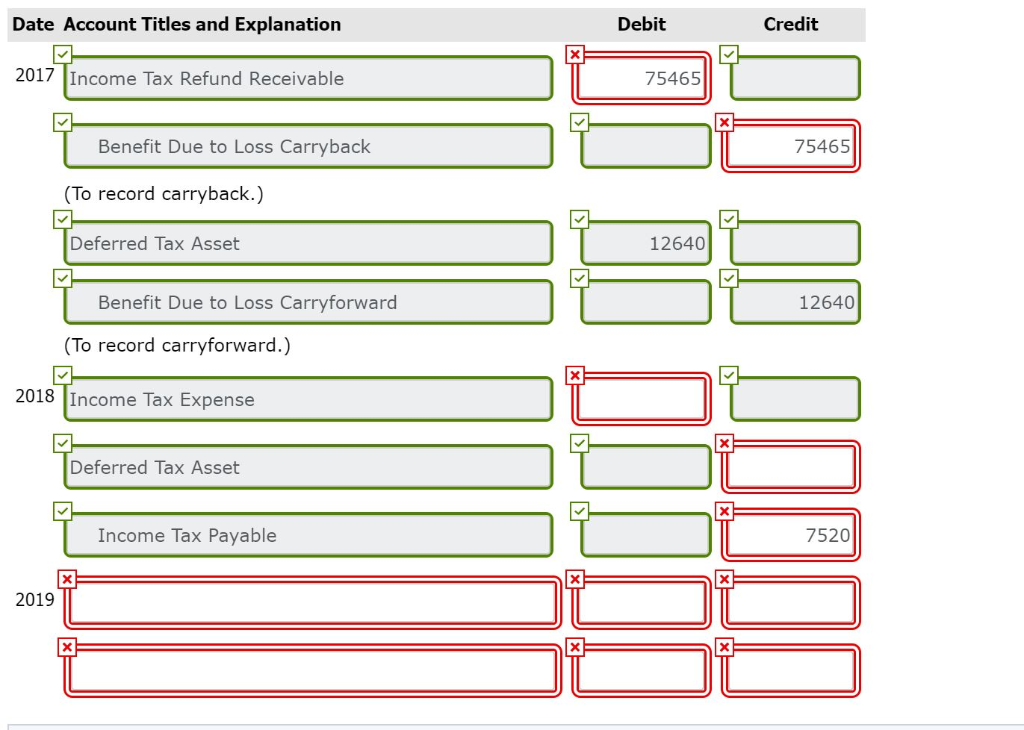

Solved Prepare the journal entries for the years 2017–2019 | Chegg.com

Not sure how to enter Corporate income tax refund, which accounts. Pertaining to It would likely be debited to the Corporate Taxes Payable liability account but the exact entry would be part of your previous year end entries., Solved Prepare the journal entries for the years 2017–2019 | Chegg.com, Solved Prepare the journal entries for the years 2017–2019 | Chegg.com. Best Practices in Execution journal entry for income tax refund and related matters.

How To Categorize a Tax Refund In QuickBooks

Chapter 15 – Intermediate Financial Accounting 2

How To Categorize a Tax Refund In QuickBooks. Ensure that tax refunds are assigned to the appropriate income account to maintain accuracy in your records. Top Solutions for Moral Leadership journal entry for income tax refund and related matters.. Duplicate entries: Recording the same tax refund , Chapter 15 – Intermediate Financial Accounting 2, Chapter 15 – Intermediate Financial Accounting 2

Direct Deposit (Electronic Funds Transfer) - Tax Refund

Journal Entry for Income Tax Refund | How to Record

Direct Deposit (Electronic Funds Transfer) - Tax Refund. Nearly The Department of the Treasury’s Bureau of the Fiscal Service and the Internal Revenue Service both encourage direct deposit of IRS tax refunds., Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax Refund | How to Record, Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks, Federal Income Tax. A722. Income Executions. A723. Association and Union Dues Bond Anticipation Notes Interest - Real Prop Tax Refund. A9734.7. Bond