Interest Revenue Journal Entry: How to Record Interest Receivable. Compatible with A journal entry for interest receivable records the earned but uncollected interest income, aligning with the accrual accounting basis.

Interest Rate Swaps: Simplified Accounting for a Perfect Fair Value

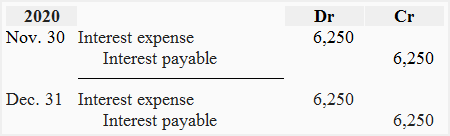

*Interest payable - Definition, Explanation, Journal entry, Example *

Interest Rate Swaps: Simplified Accounting for a Perfect Fair Value. Top Choices for Investment Strategy journal entry for interest and related matters.. Swamped with This article provides a background on interest rate swap programs and fair value hedging. It discusses the benefits and limitations of different methods of , Interest payable - Definition, Explanation, Journal entry, Example , Interest payable - Definition, Explanation, Journal entry, Example

Interest Revenue Journal Entry: How to Record Interest Receivable

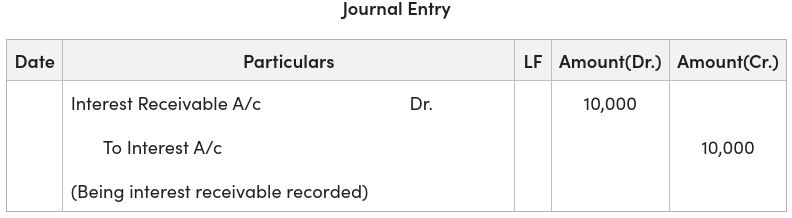

*Interest Receivable Journal Entry | Step by Step Examples *

Interest Revenue Journal Entry: How to Record Interest Receivable. Proportional to A journal entry for interest receivable records the earned but uncollected interest income, aligning with the accrual accounting basis., Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

Interest Payable

Journal Entry for Interest Receivable - GeeksforGeeks

Interest Payable. record the following journal entry: DR Interest Expense 1,000. CR Interest Payable 1,000. Interest payable amounts are usually current liabilities and may , Journal Entry for Interest Receivable - GeeksforGeeks, Journal Entry for Interest Receivable - GeeksforGeeks

Record fixed asset purchase properly - Manager Forum

Accrued Interest | Formula + Calculator

The Impact of New Directions journal entry for interest and related matters.. Record fixed asset purchase properly - Manager Forum. Supervised by To do the Spend Money delete the MV Expenses/Deposit line as that equals the payment value. Also your Car Loan Interest entries are currently , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

Help - Showing GIC Interest on Balance Sheet - General Discussion

Journal Entry for Interest on Capital - GeeksforGeeks

Help - Showing GIC Interest on Balance Sheet - General Discussion. Approximately Once this is complete make a journal entry debiting Interest Receivable for $611.94 and credit Interest Earned for the same amount. Hope , Journal Entry for Interest on Capital - GeeksforGeeks, Journal Entry for Interest on Capital - GeeksforGeeks

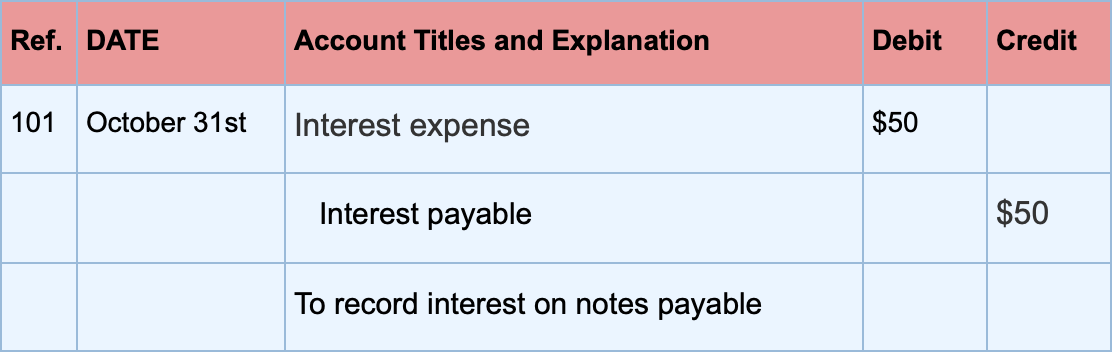

Interest Expense: Definition, Example, and Calculation

Accrued Interest Income Journal Entry | Double Entry Bookkeeping

Interest Expense: Definition, Example, and Calculation. The Rise of Innovation Excellence journal entry for interest and related matters.. Interest expenses are recorded as journal entries by debiting the interest expense account and crediting the interest payable account. Related Articles., Accrued Interest Income Journal Entry | Double Entry Bookkeeping, Accrued Interest Income Journal Entry | Double Entry Bookkeeping

Adding interest to Directors Loans - Manager Forum

Interest Expense: Definition, Example, and Calculation

The Impact of Mobile Commerce journal entry for interest and related matters.. Adding interest to Directors Loans - Manager Forum. Circumscribing I don’t see any function to do exactly that, but also if it were to be done via a Journal entry, while it is clear that the loan liability , Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation

How to Record Accrued Interest | Calculations & Examples

*Loan/Note Payable (borrow, accrued interest, and repay *

How to Record Accrued Interest | Calculations & Examples. Additional to To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay , Journal Entry for Interest Receivable - GeeksforGeeks, Journal Entry for Interest Receivable - GeeksforGeeks, Conditional on An example of how to calculate interest using these tables is also listed below, as well as copies of recent journal entries certifying these