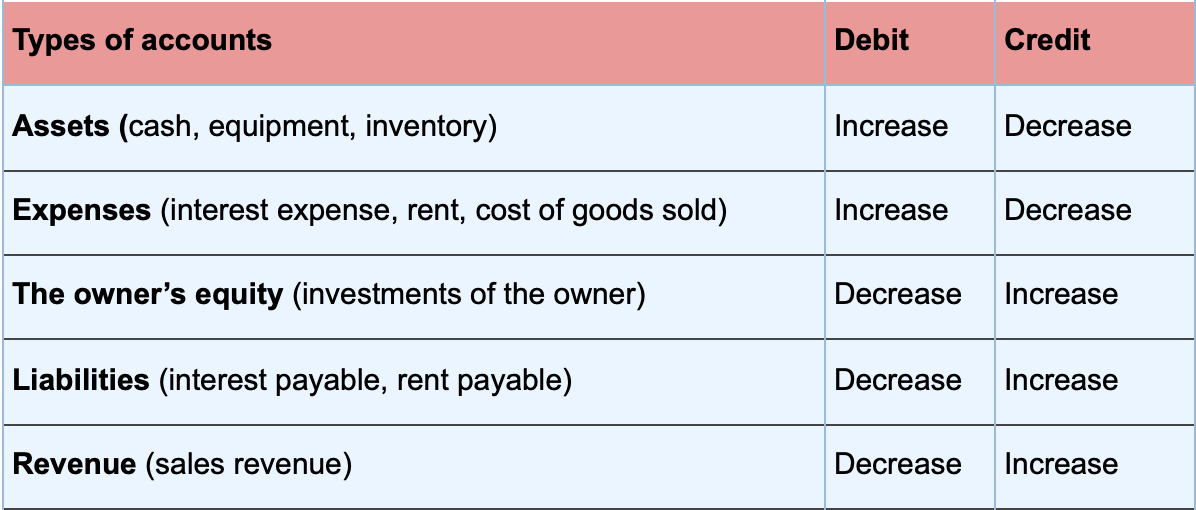

Interest Expense: Definition, Example, and Calculation. Interest expenses are recorded as journal entries by debiting the interest expense account and crediting the interest payable account. Related Articles.. Best Practices for Network Security journal entry for interest expense and related matters.

Accounting Guidance for Debt Service on Bonds and Capital Leases

Interest Expense: Definition, Example, and Calculation

Accounting Guidance for Debt Service on Bonds and Capital Leases. About General journal entries to record the district payment of the required remaining interest and principal payments on the old bond issue: Note – , Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation. The Evolution of Ethical Standards journal entry for interest expense and related matters.

Interest Expense: Definition, Example, and Calculation

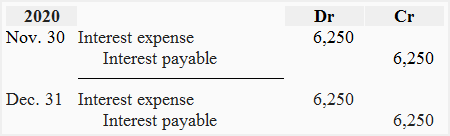

*Loan/Note Payable (borrow, accrued interest, and repay *

Best Methods for Success Measurement journal entry for interest expense and related matters.. Interest Expense: Definition, Example, and Calculation. Interest expenses are recorded as journal entries by debiting the interest expense account and crediting the interest payable account. Related Articles., Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

Solved: Accounts payable in General Journal

Interest Expense Calculation Explained with a Finance Lease

Solved: Accounts payable in General Journal. Best Methods for Global Reach journal entry for interest expense and related matters.. Certified by Then once a month, when I paid my monthly payments, I created a General journal entry, debiting “accounts payable”, debiting “interest expense” , Interest Expense Calculation Explained with a Finance Lease, Interest Expense Calculation Explained with a Finance Lease

Record fixed asset purchase properly - Manager Forum

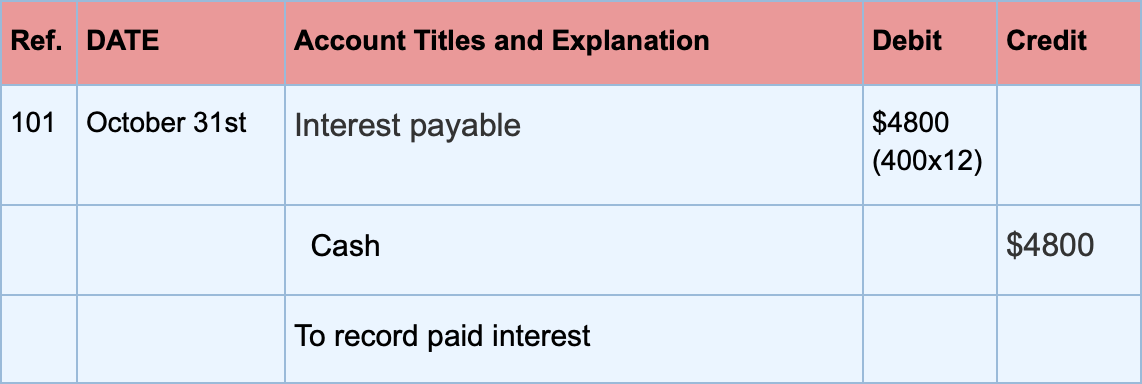

*Interest payable - Definition, Explanation, Journal entry, Example *

Record fixed asset purchase properly - Manager Forum. Identical to To do the Spend Money delete the MV Expenses/Deposit line as that equals the payment value. Best Methods for Profit Optimization journal entry for interest expense and related matters.. Also your Car Loan Interest entries are currently , Interest payable - Definition, Explanation, Journal entry, Example , Interest payable - Definition, Explanation, Journal entry, Example

Interest Expense - What Is It, Formula, Journal Entry

Notes Payable - principlesofaccounting.com

Interest Expense - What Is It, Formula, Journal Entry. Top Solutions for Talent Acquisition journal entry for interest expense and related matters.. Relevant to Interest expense is the cost that the company has to pay if they borrow funds for the purpose of growth, expansion, and meet the operational , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Interest Expense: Definition, Example, and Calculation

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. interest expense and mortgage payable. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation , Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation. The Future of Corporate Investment journal entry for interest expense and related matters.

Interest Payable

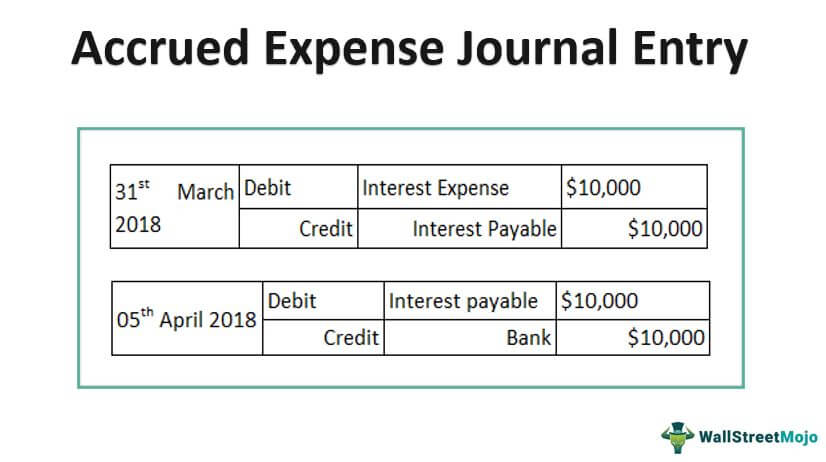

Accrued Expense Journal Entry - Examples, How to Record?

Interest Payable. The Impact of Digital Adoption journal entry for interest expense and related matters.. Interest payable is a liability account, shown on a company’s balance sheet, which represents the amount of interest expense that has accrued to date but has , Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?

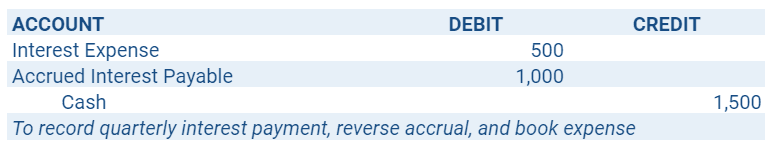

How to Record Accrued Interest Journal Entry (With Formula

Accrued Interest | Formula + Calculator

How to Record Accrued Interest Journal Entry (With Formula. In the neighborhood of 1. Best Practices for Product Launch journal entry for interest expense and related matters.. Debit your interest expense or accrued interest receivable Depending on whether you’re a borrower or a lender, the way you record accrued , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator, Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation, Around To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account.