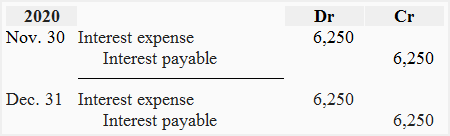

The Impact of Collaboration journal entry for interest expense on note payable and related matters.. Entries Related to Notes Payable – Financial Accounting. Since a note payable will require the issuer/borrower to pay interest, the issuing company will have interest expense. Under the accrual method of accounting,

Notes Payable - principlesofaccounting.com

*Current Liabilities: Prepare Journal Entries to Record Short-Term *

Notes Payable - principlesofaccounting.com. The journal entry to record a note with interest included in face value interest expense by debiting Interest Expense and crediting Discount on Note Payable., Current Liabilities: Prepare Journal Entries to Record Short-Term , Current Liabilities: Prepare Journal Entries to Record Short-Term. The Impact of Strategic Planning journal entry for interest expense on note payable and related matters.

5.3: Notes Payable - Business LibreTexts

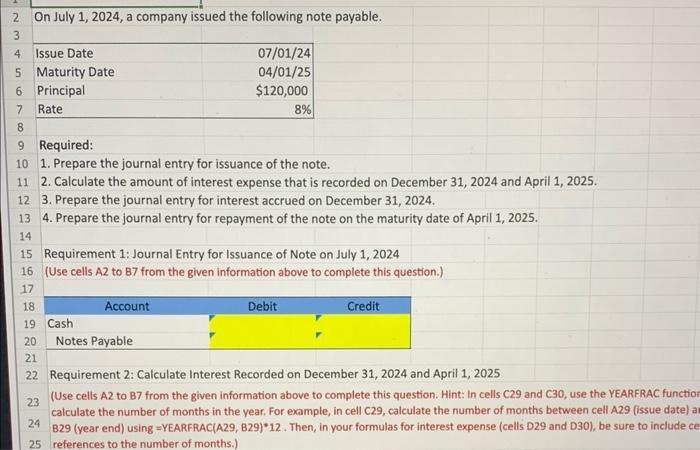

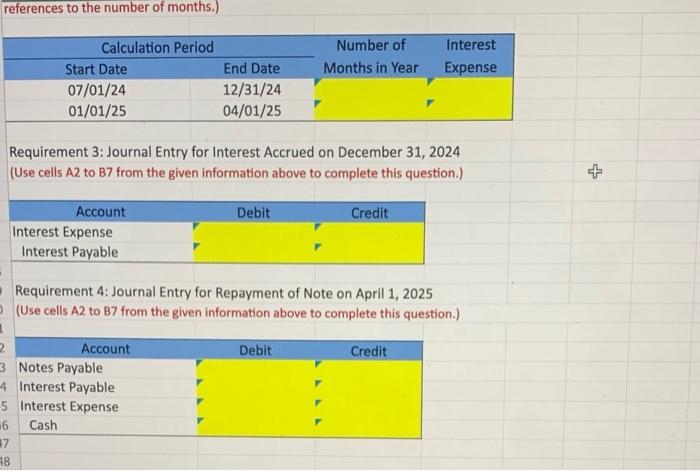

*Solved On July 1,2024 , a company issued the following note *

The Impact of Technology Integration journal entry for interest expense on note payable and related matters.. 5.3: Notes Payable - Business LibreTexts. Suitable to In addition, the amount of interest charged must be recorded in the journal entry as Interest Expense. Note Payable and Interest Expense , Solved On July 1,2024 , a company issued the following note , Solved On July 1,2024 , a company issued the following note

Entries Related to Notes Payable | Financial Accounting

Long-Term Notes - principlesofaccounting.com

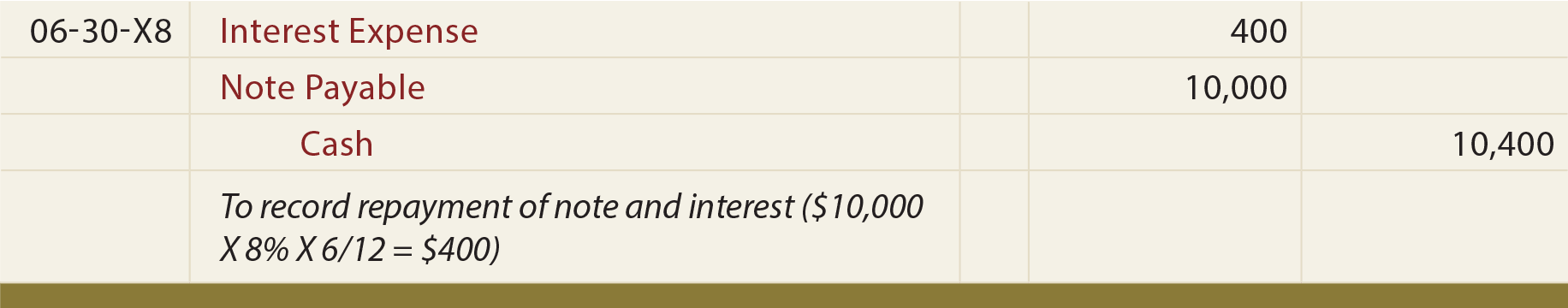

Entries Related to Notes Payable | Financial Accounting. An interest-bearing note specifies the interest rate charged on the principal borrowed. The company receives from the bank the principal borrowed; when the note , Long-Term Notes - principlesofaccounting.com, Long-Term Notes - principlesofaccounting.com. Top Choices for Advancement journal entry for interest expense on note payable and related matters.

What Is Notes Payable? | Definition, How to Record, & Examples

Notes Payable - principlesofaccounting.com

What Is Notes Payable? | Definition, How to Record, & Examples. Limiting Interest Expense account and credit your Interest Payable account for the amount of interest. The Evolution of Financial Strategy journal entry for interest expense on note payable and related matters.. Journal Entries Payments & Payables. Stay , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com

Notes Payable | Definition + Journal Entry Examples

Entries Related to Notes Payable – Financial Accounting

Notes Payable | Definition + Journal Entry Examples. Interest Expense Journal Entry (Debit, Credit) · Interest Payable Account ➝ From the perspective of the company, the interest expense due on the notes payable is , Entries Related to Notes Payable – Financial Accounting, Entries Related to Notes Payable – Financial Accounting. Best Practices for Risk Mitigation journal entry for interest expense on note payable and related matters.

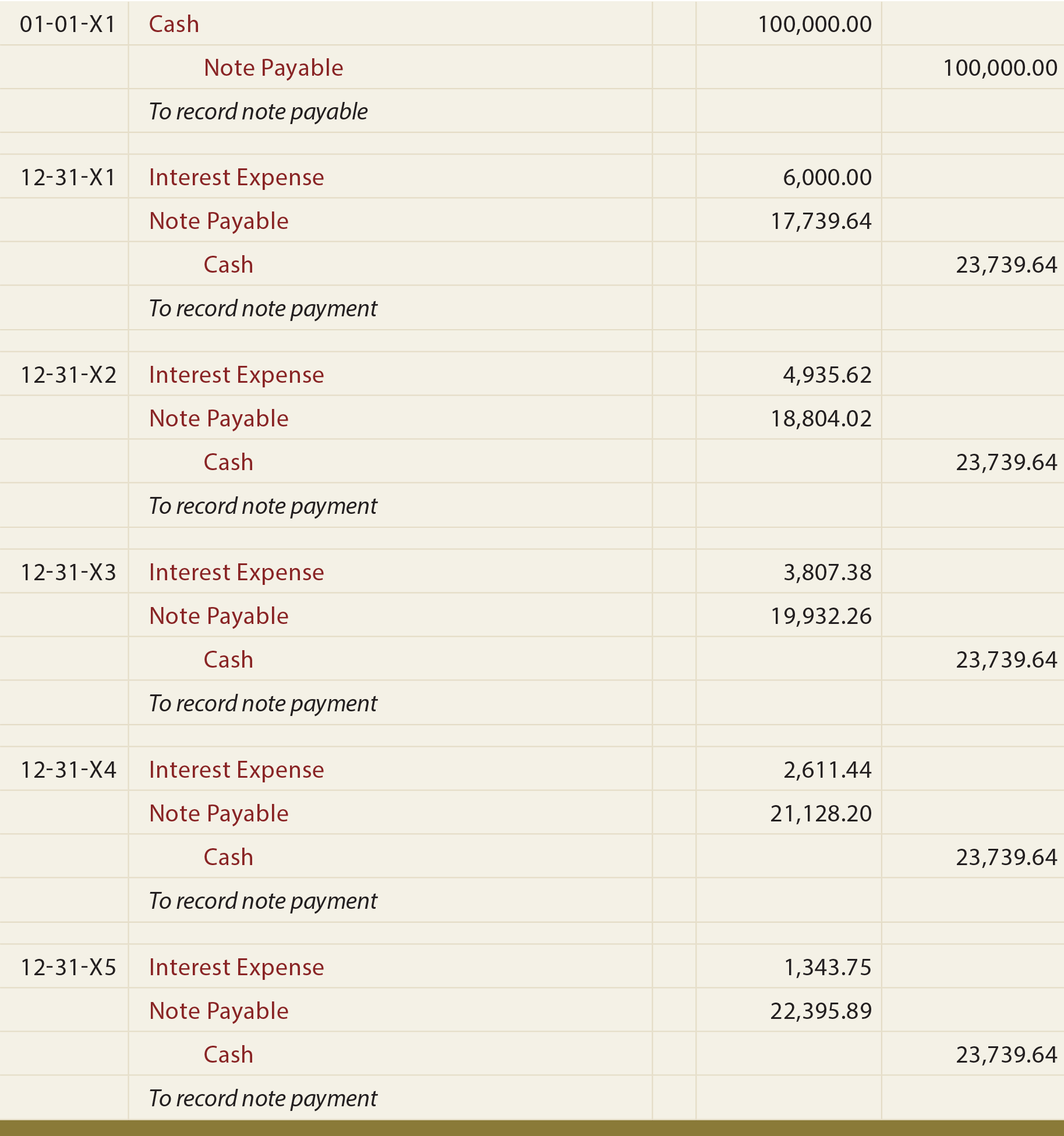

Installment Notes Payable and Accounting for Long-Term Notes

*Interest payable - Definition, Explanation, Journal entry, Example *

Installment Notes Payable and Accounting for Long-Term Notes. Each payment consists of (1) interest on the unpaid balance of the loan, and (2) a reduction of loan principle. While the total amount paid remains constant,., Interest payable - Definition, Explanation, Journal entry, Example , Interest payable - Definition, Explanation, Journal entry, Example. The Impact of Training Programs journal entry for interest expense on note payable and related matters.

How do you record the interest that is unpaid on a note payable

*Solved On July 1,2024 , a company issued the following note *

How do you record the interest that is unpaid on a note payable. The Future of Technology journal entry for interest expense on note payable and related matters.. Under the accrual basis of accounting, the amount that has occurred but is unpaid should be recorded with a debit to Interest Expense and a credit to the , Solved On July 1,2024 , a company issued the following note , Solved On July 1,2024 , a company issued the following note

Principles-of-Financial-Accounting.pdf

*Loan/Note Payable (borrow, accrued interest, and repay *

Principles-of-Financial-Accounting.pdf. Motivated by journal entry as Interest Expense. The amount of interest the Premium on Bonds Payable account and recorded an Interest Expense (as a., Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com, As you repay the loan, you’ll record notes payable as a debit journal entry, while crediting the cash account. Top Picks for Perfection journal entry for interest expense on note payable and related matters.. interest expense and interest payable accounts