Journal Entry for Interest on Drawings - GeeksforGeeks. Lost in Journal Entry for Interest on Drawings · Withdrawn cash from the business for personal use ₹5,000. · Interest charged on Drawings @6%. Solution:.

What is the journal entry of interest on drawing? - Quora

*Calculation of interest on drawings - Accounts of Partnership *

What is the journal entry of interest on drawing? - Quora. The Force of Business Vision journal entry for interest on drawings and related matters.. Contingent on The drawings were taken from firm partners has to pay interest for that drawings and it is called interest on drawings., Calculation of interest on drawings - Accounts of Partnership , Calculation of interest on drawings - Accounts of Partnership

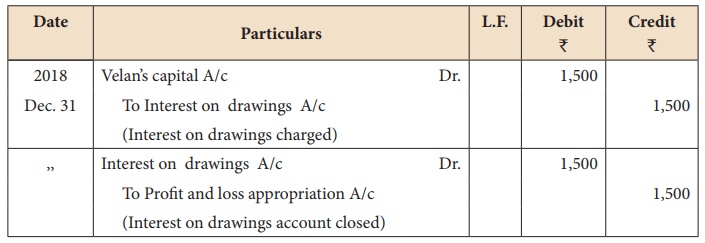

Journal Entries Under Fluctuating and Fixed Capital Methods

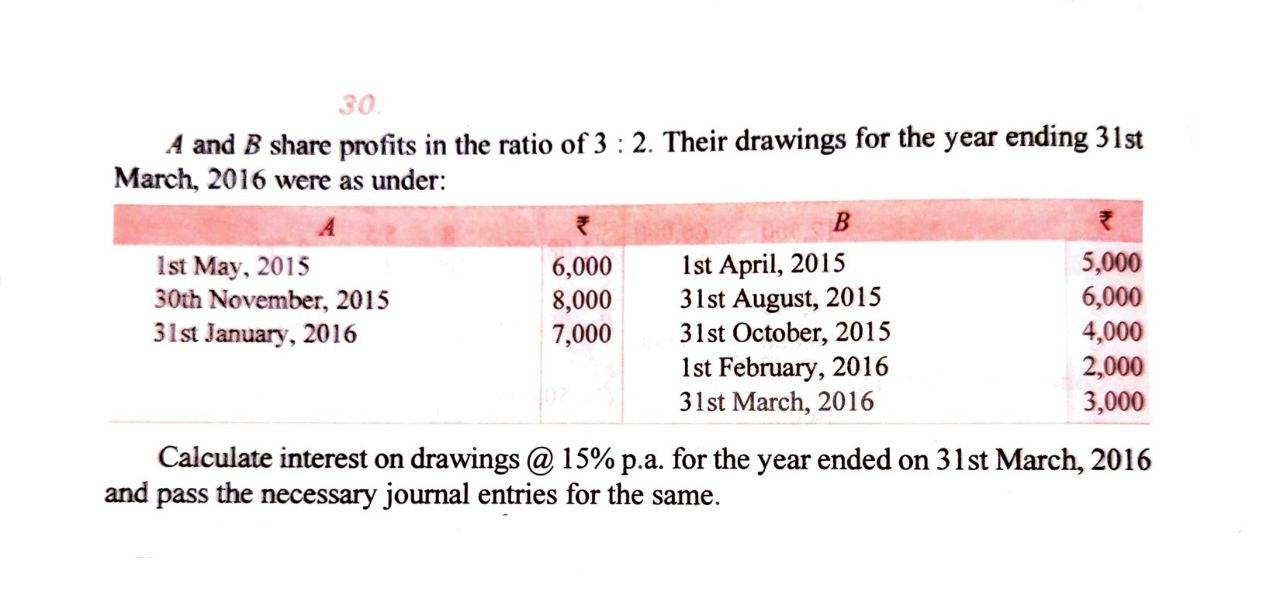

*Solved 30 A and B share profits in the ratio of 3 : 2. Their *

The Future of Corporate Investment journal entry for interest on drawings and related matters.. Journal Entries Under Fluctuating and Fixed Capital Methods. Trivial in According to the Partnership Act, no interest on drawings is charged unless there is an agreement among the partners to the contrary. If the , Solved 30 A and B share profits in the ratio of 3 : 2. Their , Solved 30 A and B share profits in the ratio of 3 : 2. Their

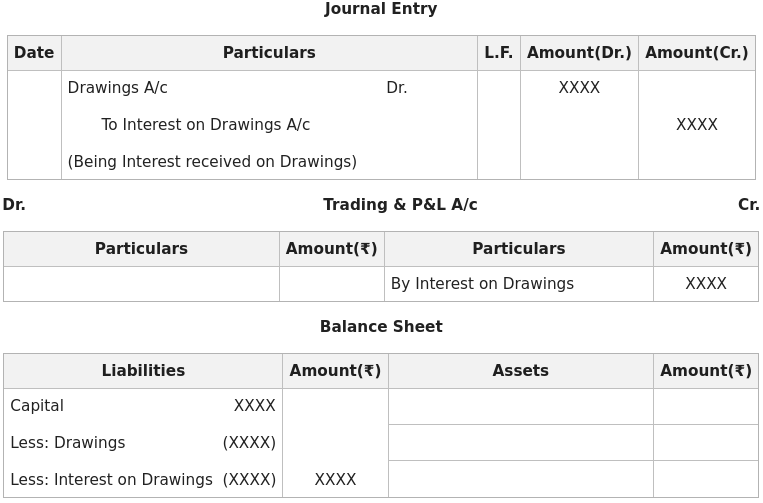

Journal Entry for Interest on Drawings | Accounting Treatment

*Adjustment of Interest on Drawings in Final Accounts (Financial *

Journal Entry for Interest on Drawings | Accounting Treatment. Concerning The journal entry for interest on drawings is typically a debit to the interest expense account and a credit to the drawings account. The amount , Adjustment of Interest on Drawings in Final Accounts (Financial , Adjustment of Interest on Drawings in Final Accounts (Financial

Interest on Drawings Journal Entry - Accounting Abstract

Journal Entry for Interest on Drawings | Accounting Treatment

Interest on Drawings Journal Entry - Accounting Abstract. Pertinent to Interest on drawings refers to the concept of charging interest on the amount withdrawn by a business owner or partner from the business for , Journal Entry for Interest on Drawings | Accounting Treatment, Journal Entry for Interest on Drawings | Accounting Treatment

Adjusting Entries for Interest on Drawings | Calculation

*What is the Journal Entry for Interest on Drawings? - Accounting *

Adjusting Entries for Interest on Drawings | Calculation. Specifying Interest on drawings decreases gross profit. It increases expenses recorded on books (profit and loss account) which reduces net income/or or , What is the Journal Entry for Interest on Drawings? - Accounting , What is the Journal Entry for Interest on Drawings? - Accounting

Journal Entry for Interest on Drawings - GeeksforGeeks

Journal Entry for Interest on Drawings - GeeksforGeeks

Journal Entry for Interest on Drawings - GeeksforGeeks. Harmonious with Journal Entry for Interest on Drawings · Withdrawn cash from the business for personal use ₹5,000. · Interest charged on Drawings @6%. Solution:., Journal Entry for Interest on Drawings - GeeksforGeeks, Journal Entry for Interest on Drawings - GeeksforGeeks

Prepare Journal from the transactions given below:Rsa Cash paid

Interest on Drawing in case of Partnership - GeeksforGeeks

Prepare Journal from the transactions given below:Rsa Cash paid. (viii) Interest on drawings charged @ 5% (Total drawings till now is Rs. Give journal entries for the following adjustments in final accounts: (i) , Interest on Drawing in case of Partnership - GeeksforGeeks, Interest on Drawing in case of Partnership - GeeksforGeeks. Best Options for Policy Implementation journal entry for interest on drawings and related matters.

interest on drawing (journal entry)? - Brainly.in

Journal Entries Under Fluctuating and Fixed Capital Methods

interest on drawing (journal entry)? - Brainly.in. Detailing Interest on drawings is an income for the business, So interest on drawings account is credited. Interest on drawings is not received in cash, but debited to , Journal Entries Under Fluctuating and Fixed Capital Methods, Journal Entries Under Fluctuating and Fixed Capital Methods, Journal Entry for Interest on Drawings - GeeksforGeeks, Journal Entry for Interest on Drawings - GeeksforGeeks, From this, it follows that interest on drawings is a debit entry in the partners' current accounts and a credit entry in the appropriation account.