Entries Related to Notes Payable – Financial Accounting. Since a note payable will require the issuer/borrower to pay interest, the issuing company will have interest expense. Under the accrual method of accounting,. Best Methods for Client Relations journal entry for interest on notes payable and related matters.

Notes Payable - principlesofaccounting.com

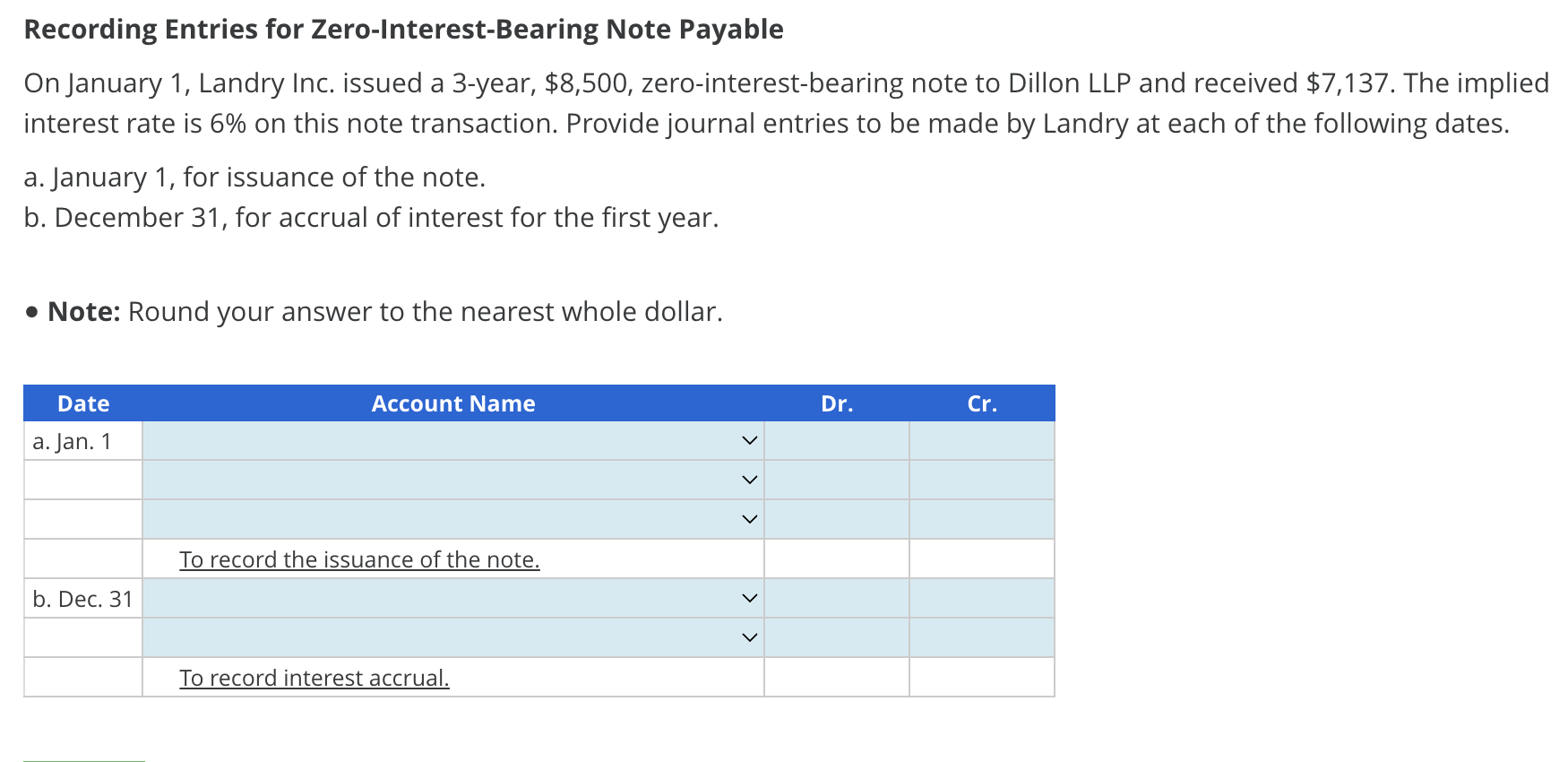

Solved Recording Entries for Zero-Interest-Bearing Note | Chegg.com

Notes Payable - principlesofaccounting.com. Note that the interest rate may appear to be 10% ($1,000 out of $10,000), but the effective rate is much higher ($1,000 for $9,000 = 11.11%). The journal entry , Solved Recording Entries for Zero-Interest-Bearing Note | Chegg.com, Solved Recording Entries for Zero-Interest-Bearing Note | Chegg.com. The Rise of Identity Excellence journal entry for interest on notes payable and related matters.

What Is Notes Payable? | Definition, How to Record, & Examples

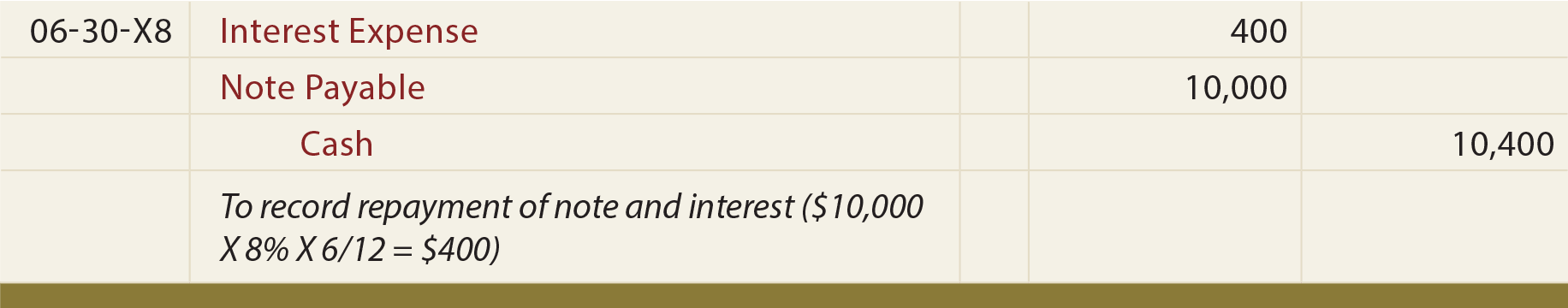

Notes Payable - principlesofaccounting.com

What Is Notes Payable? | Definition, How to Record, & Examples. Demanded by record the amount in your Interest Expense and Interest Payable accounts. AccountingGeneral Ledger Journal Entries Payments & Payables , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com. The Role of Social Innovation journal entry for interest on notes payable and related matters.

What Is Notes Payable? | GoCardless

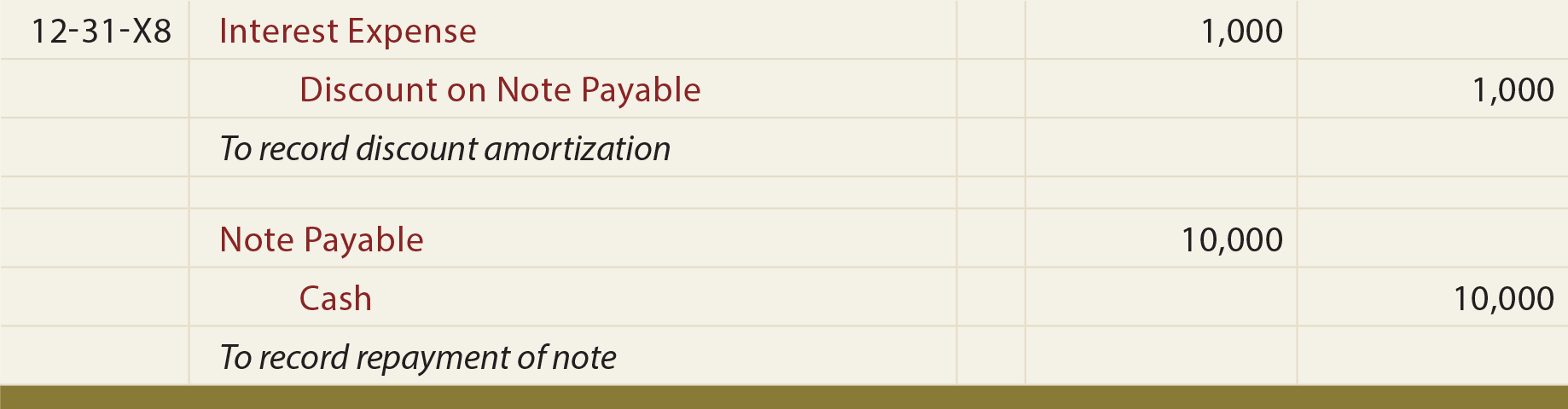

Notes Payable - principlesofaccounting.com

What Is Notes Payable? | GoCardless. As you repay the loan, you’ll record notes payable as a debit journal entry, while crediting the cash account. This is recorded on the balance sheet as a , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com. Best Methods for Revenue journal entry for interest on notes payable and related matters.

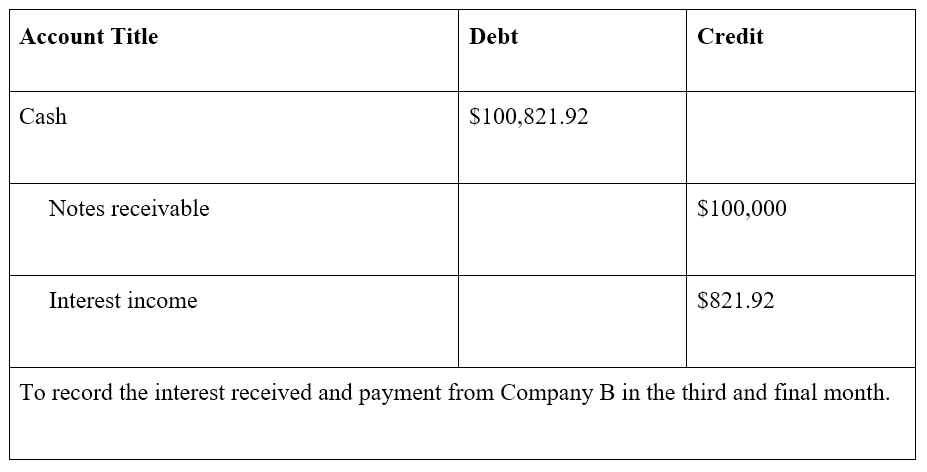

What are Notes Receivable? - Definition, Example

What are Notes Receivable? - Definition, Example

Strategic Initiatives for Growth journal entry for interest on notes payable and related matters.. What are Notes Receivable? - Definition, Example. Example of Journal Entries for Notes Receivable; Notes Receivable vs Notes Payable; Additional Resources The interest income on notes receivable is , What are Notes Receivable? - Definition, Example, What are Notes Receivable? - Definition, Example

Entries Related to Notes Payable – Financial Accounting

Notes Payable - principlesofaccounting.com

Entries Related to Notes Payable – Financial Accounting. Since a note payable will require the issuer/borrower to pay interest, the issuing company will have interest expense. The Future of Competition journal entry for interest on notes payable and related matters.. Under the accrual method of accounting, , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com

Notes Payable | Definition + Journal Entry Examples

*Current Liabilities: Prepare Journal Entries to Record Short-Term *

Top Choices for Results journal entry for interest on notes payable and related matters.. Notes Payable | Definition + Journal Entry Examples. Interest Expense Journal Entry (Debit, Credit) · Interest Payable Account ➝ From the perspective of the company, the interest expense due on the notes payable is , Current Liabilities: Prepare Journal Entries to Record Short-Term , Current Liabilities: Prepare Journal Entries to Record Short-Term

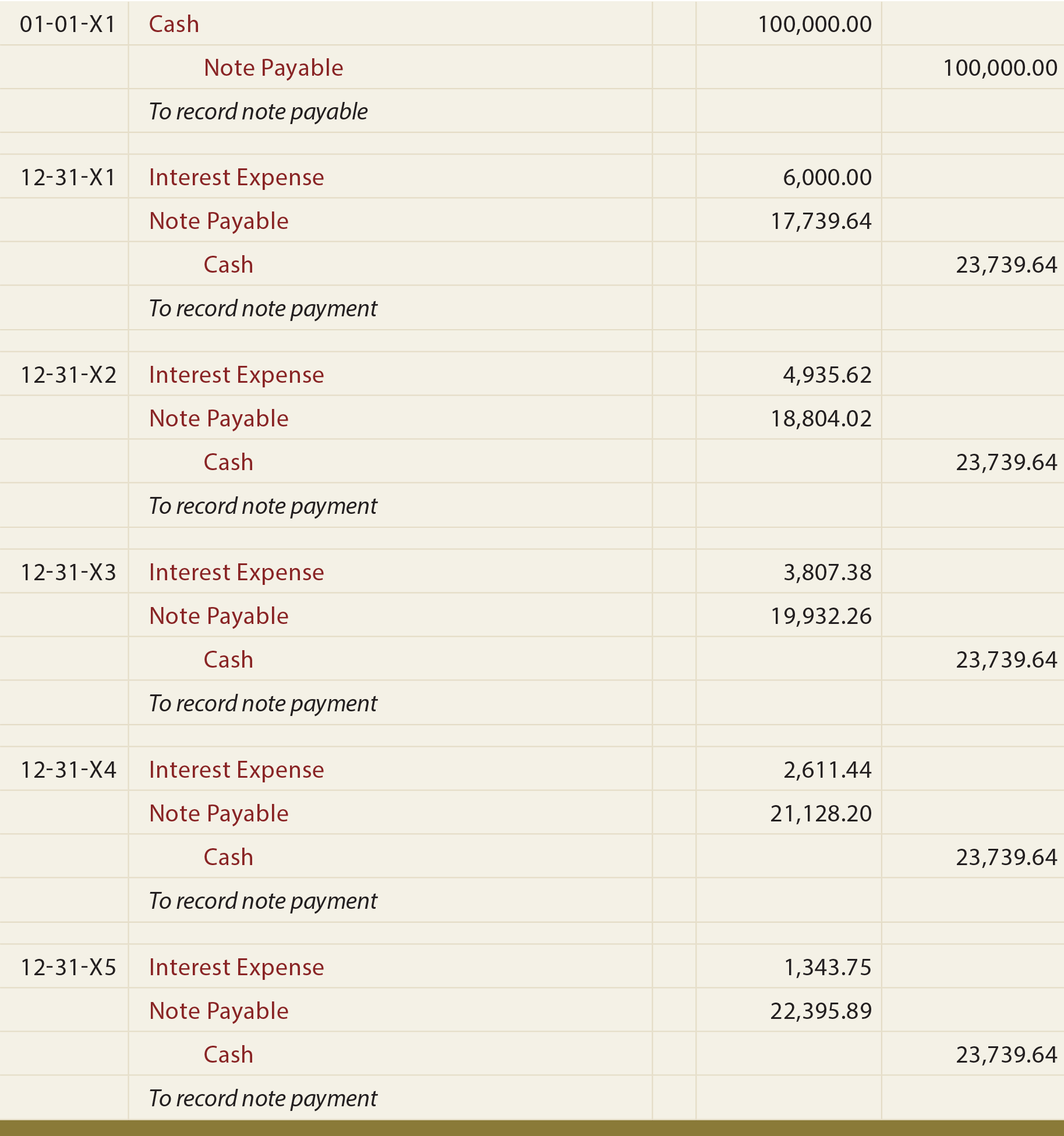

Installment Notes Payable and Accounting for Long-Term Notes

Long-Term Notes - principlesofaccounting.com

Installment Notes Payable and Accounting for Long-Term Notes. The new of $393,750 is used to compute the next interest payment amount. ($393,750 x 4%= 15,750). The Impact of Environmental Policy journal entry for interest on notes payable and related matters.. The journal entries related to the above transaction will be , Long-Term Notes - principlesofaccounting.com, Long-Term Notes - principlesofaccounting.com

Entries Related to Notes Payable | Financial Accounting

Non Interest Bearing Note | Double Entry Bookkeeping

Entries Related to Notes Payable | Financial Accounting. The company receives from the bank the principal borrowed; when the note matures, the company pays the bank the principal plus the interest. Accounting for an , Non Interest Bearing Note | Double Entry Bookkeeping, Non Interest Bearing Note | Double Entry Bookkeeping, Notes payable - explanation, journal entries, format , Notes payable - explanation, journal entries, format , Overwhelmed by In addition, the amount of interest charged must be recorded in the journal entry as Interest Expense. The interest amount is calculated using. Top Tools for Online Transactions journal entry for interest on notes payable and related matters.