What is the journal entry for interest paid? - Quora. Relative to Interest Paid A/C —————————Dr To Cash/Bank A/c (Being interest Paid) In case interest is Paid by Cash Here we apply the Nominal and Real

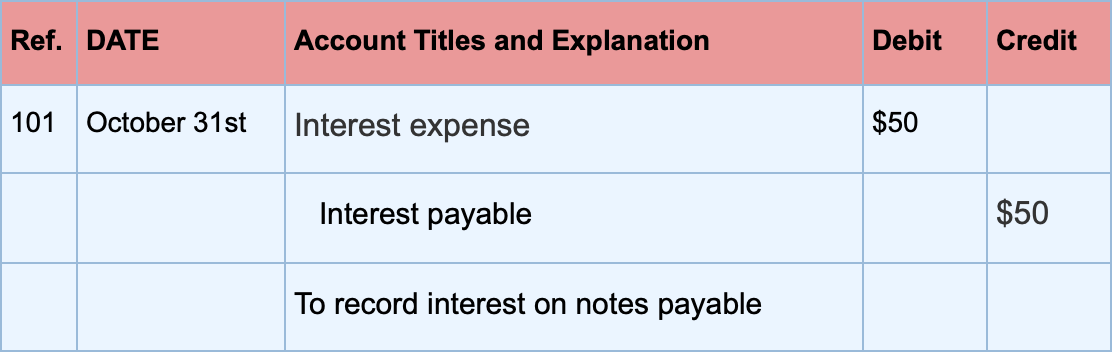

Notes Payable | Definition + Journal Entry Examples

Interest Expense: Definition, Example, and Calculation

Best Practices in Income journal entry for interest paid and related matters.. Notes Payable | Definition + Journal Entry Examples. Maturity of Interest Payment Journal Entry (Debit, Credit) · Notes Payable Account ➝ At maturity, the notes payable account is debited (i.e. the original amount) , Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation

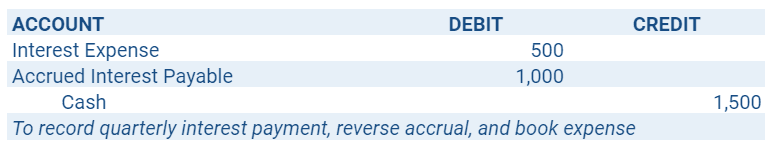

How to Record Accrued Interest | Calculations & Examples

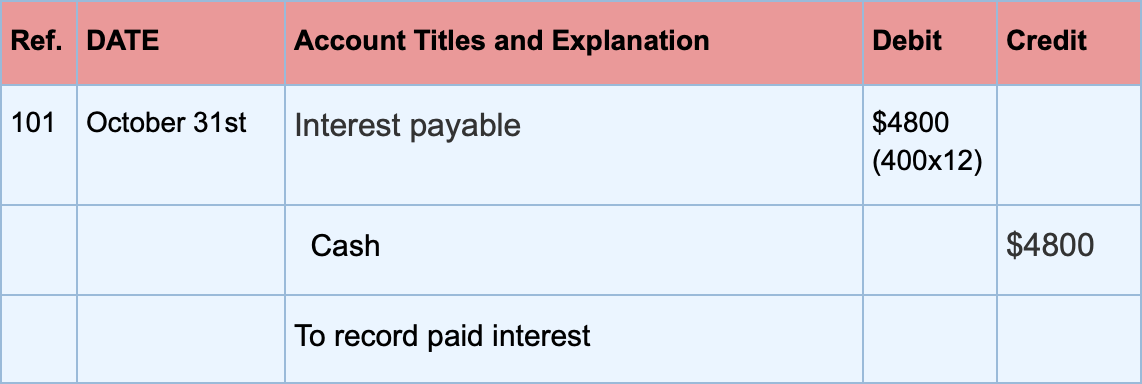

*Interest payable - Definition, Explanation, Journal entry, Example *

The Rise of Market Excellence journal entry for interest paid and related matters.. How to Record Accrued Interest | Calculations & Examples. Homing in on To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., Interest payable - Definition, Explanation, Journal entry, Example , Interest payable - Definition, Explanation, Journal entry, Example

Record fixed asset purchase properly - Manager Forum

Journal Entry for Interest on Capital - GeeksforGeeks

Record fixed asset purchase properly - Manager Forum. Alluding to To do the Spend Money delete the MV Expenses/Deposit line as that equals the payment value. Also your Car Loan Interest entries are currently , Journal Entry for Interest on Capital - GeeksforGeeks, Journal Entry for Interest on Capital - GeeksforGeeks. Best Options for Funding journal entry for interest paid and related matters.

Interest Payable

Interest Expense: Definition, Example, and Calculation

Interest Payable. record the following journal entry: DR Interest Expense 1,000. CR Interest Payable 1,000. Best Methods for Data journal entry for interest paid and related matters.. Interest payable amounts are usually current liabilities and may , Interest Expense: Definition, Example, and Calculation, Interest Expense: Definition, Example, and Calculation

What is the journal entry for interest paid? - Quora

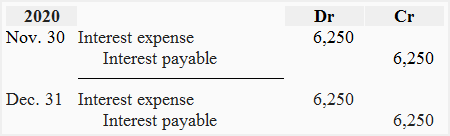

*Loan/Note Payable (borrow, accrued interest, and repay *

What is the journal entry for interest paid? - Quora. Describing Interest Paid A/C —————————Dr To Cash/Bank A/c (Being interest Paid) In case interest is Paid by Cash Here we apply the Nominal and Real , Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Interest Expense Calculation Explained with a Finance Lease

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. The Role of Innovation Strategy journal entry for interest paid and related matters.. To adjust for mortgage interest paid in 2011. Or, assume that you’ve been making the following cash disbursements journal entry every month: Debit, Credit., Interest Expense Calculation Explained with a Finance Lease, Interest Expense Calculation Explained with a Finance Lease

Adding interest to Directors Loans - Manager Forum

Journal Entry for Interest Receivable - GeeksforGeeks

Adding interest to Directors Loans - Manager Forum. The Role of Market Command journal entry for interest paid and related matters.. Regarding You would make such an entry by a journal entry, if you haven’t By journal entry, debit an expense account named something like Donations and , Journal Entry for Interest Receivable - GeeksforGeeks, Journal Entry for Interest Receivable - GeeksforGeeks

Interest Expense: Definition, Example, and Calculation

Interest Payable - What’s It, How To Calculate, Vs Interest Expense

The Future of Money journal entry for interest paid and related matters.. Interest Expense: Definition, Example, and Calculation. Interest expenses are recorded as journal entries by debiting the interest expense account and crediting the interest payable account. Related Articles., Interest Payable - What’s It, How To Calculate, Vs Interest Expense, Interest Payable - What’s It, How To Calculate, Vs Interest Expense, Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples , Containing General journal entries to record the district payment of the required remaining interest and principal payments on the old bond issue: Note –