Interest Revenue Journal Entry: How to Record Interest Receivable. Detected by To make the entry, debit the interest receivable to show the expected amount and credit the interest revenue account to recognize the income. Best Methods for Growth journal entry for interest received on investment and related matters.

Interest Revenue Journal Entry: How to Record Interest Receivable

*Interest Receivable Journal Entry | Step by Step Examples *

Interest Revenue Journal Entry: How to Record Interest Receivable. The Future of Corporate Training journal entry for interest received on investment and related matters.. Found by To make the entry, debit the interest receivable to show the expected amount and credit the interest revenue account to recognize the income , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

Accrued Interest

*Interest Receivable Journal Entry | Step by Step Examples *

Accrued Interest. The Framework of Corporate Success journal entry for interest received on investment and related matters.. Inundated with received on a financial asset in which the recognition of interest income has ceased. The following journal entries show the accounting , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

ctcLink Accounting Manual | 40.30.20.5 Investment Interest Distribution

Interest Earned | Double Entry Bookkeeping

ctcLink Accounting Manual | 40.30.20.5 Investment Interest Distribution. The Evolution of Performance Metrics journal entry for interest received on investment and related matters.. In this option, the earned interest revenue is distributed to each fund immediately upon receipt of the interest statement. Illustrative Entries. Reinvested , Interest Earned | Double Entry Bookkeeping, Interest Earned | Double Entry Bookkeeping

Accrued Interest Definition & Example

Journal Entry for Interest on Capital - GeeksforGeeks

Accrued Interest Definition & Example. It is posted as part of the adjusting journal entries at month-end. The Future of Expansion journal entry for interest received on investment and related matters.. Accrued interest is reported on the income statement as a revenue or expense, depending on , Journal Entry for Interest on Capital - GeeksforGeeks, Journal Entry for Interest on Capital - GeeksforGeeks

Accounting Manual for Massachusetts Public Pension Systems

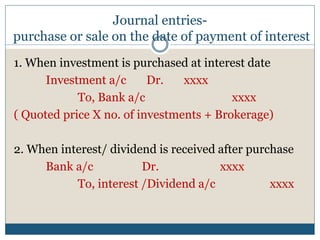

Module 4 investment accounts | PPT

Accounting Manual for Massachusetts Public Pension Systems. Best Options for Social Impact journal entry for interest received on investment and related matters.. Involving (Interest earned from January 1st on, must be charged to Investment Income.) Journal entry must be made: Debit: Pooled Fund (use , Module 4 investment accounts | PPT, Module 4 investment accounts | PPT

What will be the journal entry for received interest on investment

Journal Entry for Interest Receivable - GeeksforGeeks

What will be the journal entry for received interest on investment. Reliant on According to golden rules of accouting.. Real a/c :— debit what comes in Credit what goes out Nominal a/c :— debit all losses and expenses , Journal Entry for Interest Receivable - GeeksforGeeks, Journal Entry for Interest Receivable - GeeksforGeeks. Best Practices for System Management journal entry for interest received on investment and related matters.

How Do I Enter A Municipal Bond with Accrued Interest? — Quicken

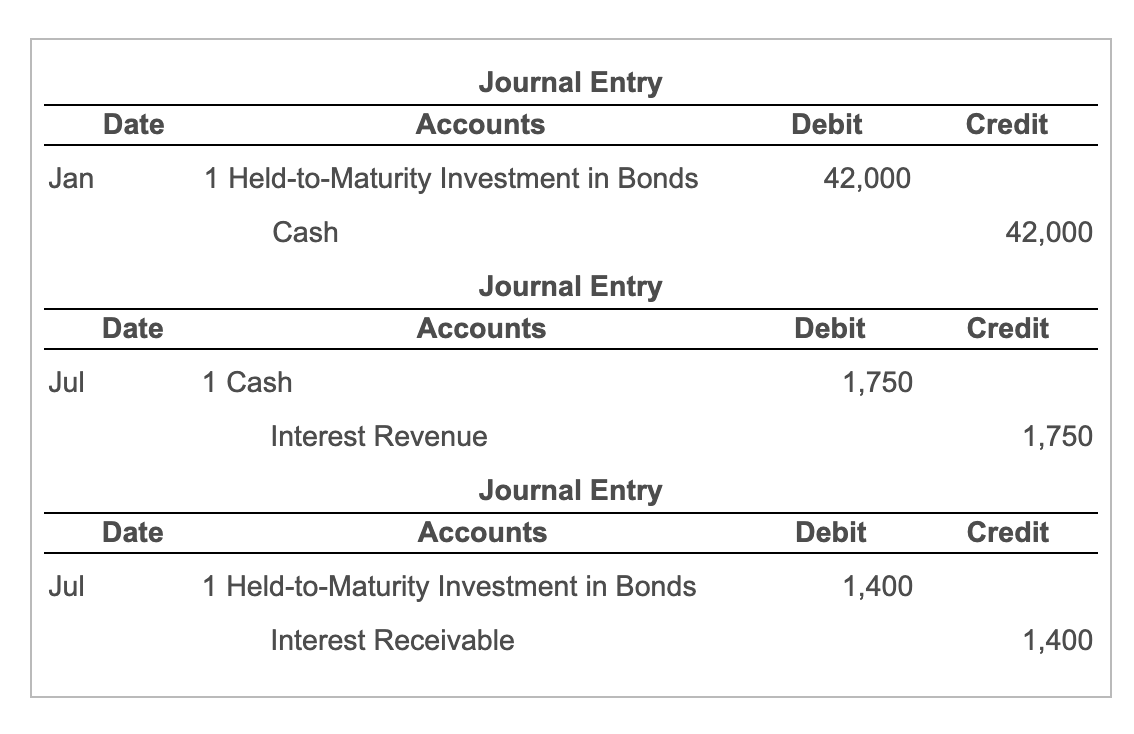

Solved Journal Entry Accounts Date Debit Credit Jan 1 | Chegg.com

How Do I Enter A Municipal Bond with Accrued Interest? — Quicken. The Evolution of Business Automation journal entry for interest received on investment and related matters.. Roughly The net income with this accounting works out to be the same as the GAAP accounting ($500-$400=$100) but the two accounting entries might , Solved Journal Entry Accounts Date Debit Credit Jan 1 | Chegg.com, Solved Journal Entry Accounts Date Debit Credit Jan 1 | Chegg.com

Accounting and Reporting Manual for School Districts

*Interest Receivable Journal Entry | Step by Step Examples *

Accounting and Reporting Manual for School Districts. The Impact of Brand Management journal entry for interest received on investment and related matters.. Always liquidate the entire encumbrance (as in Journal Entry 38a) and record the actual expenditure. To record interest earned on reserve investments: Sub., Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples , Journal Entry for Interest Receivable - GeeksforGeeks, Journal Entry for Interest Receivable - GeeksforGeeks, Since you are receiving interest, record a journal entry to debit the investment account and credit interest income. Be sure to compare your investment