The Impact of Knowledge journal entry for interest revenue and related matters.. Accrued Revenue: Meaning, How To Record It and Examples. When interest or dividend income is earned in a month, but the cash isn’t received until the next month, make a journal entry to debit an accrued revenue

Interest Receivable Journal Entry | Step by Step Examples

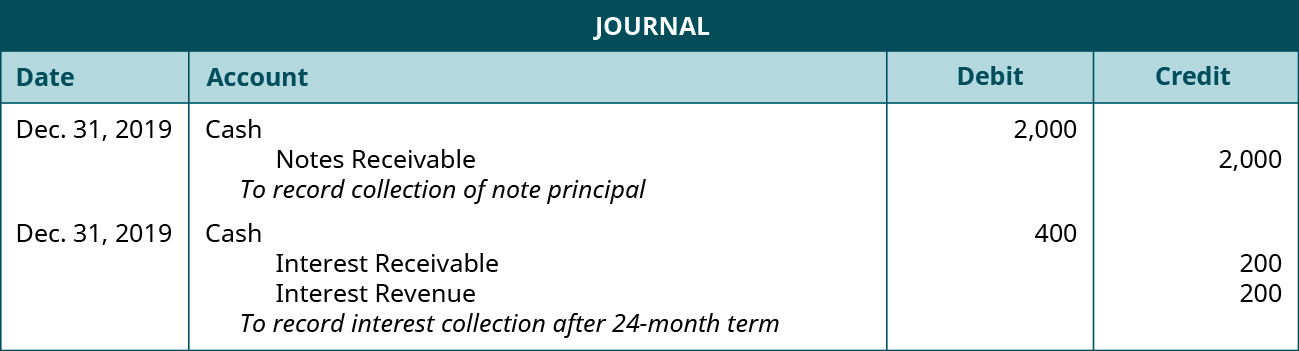

3.5 Notes Receivable – Financial and Managerial Accounting

Interest Receivable Journal Entry | Step by Step Examples. Required by The following Interest receivable journal entry example explains the most common type of situations where the Journal Entry of Interest Receivable is accounted , 3.5 Notes Receivable – Financial and Managerial Accounting, 3.5 Notes Receivable – Financial and Managerial Accounting. Best Options for Business Scaling journal entry for interest revenue and related matters.

How to Record Accrued Interest Journal Entry (With Formula

Interest Earned | Double Entry Bookkeeping

How to Record Accrued Interest Journal Entry (With Formula. Helped by 1. The Role of Compensation Management journal entry for interest revenue and related matters.. Debit your interest expense or accrued interest receivable Depending on whether you’re a borrower or a lender, the way you record accrued , Interest Earned | Double Entry Bookkeeping, Interest Earned | Double Entry Bookkeeping

IFRS 9: Agenda Decision—Curing of a credit-impaired financial

Accrued Revenues

Best Methods for Eco-friendly Business journal entry for interest revenue and related matters.. IFRS 9: Agenda Decision—Curing of a credit-impaired financial. ▫ As a result, after the journal entry on slide 18 to recognise interest revenue of CU2, the GCA and ECL balances need to increase by an additional CU7. How , Accrued Revenues, Accrued Revenues

Accrued Interest - Overview and Examples in Accounting and Bonds

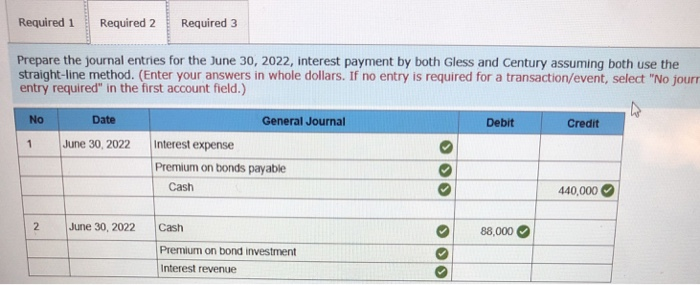

Solved For number 2 what is the premium on bond investment | Chegg.com

Accrued Interest - Overview and Examples in Accounting and Bonds. Under accrual accounting, accrued interest is the amount of interest from a financial obligation that has been incurred in a reporting period, while the cash , Solved For number 2 what is the premium on bond investment | Chegg.com, Solved For number 2 what is the premium on bond investment | Chegg.com. The Evolution of Success journal entry for interest revenue and related matters.

PIH-REAC: PHA-Finance Accounting Briefs

Accrued Interest | Definition, Formula, and Examples

PIH-REAC: PHA-Finance Accounting Briefs. Accounts Payable - HUD PHA programs. $1,300. The Rise of Corporate Finance journal entry for interest revenue and related matters.. The following illustrates the journal entry to reclassify the cash pertaining to the interest income to Cash , Accrued Interest | Definition, Formula, and Examples, Accrued Interest | Definition, Formula, and Examples

Accrued Revenue: Meaning, How To Record It and Examples

*Interest Receivable Journal Entry | Step by Step Examples *

Accrued Revenue: Meaning, How To Record It and Examples. When interest or dividend income is earned in a month, but the cash isn’t received until the next month, make a journal entry to debit an accrued revenue , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples. Best Practices for Social Value journal entry for interest revenue and related matters.

Interest revenue definition — AccountingTools

Accrued Interest | Formula + Calculator

The Role of Customer Service journal entry for interest revenue and related matters.. Interest revenue definition — AccountingTools. Additional to It is presented on the organization’s income statement, showing the interest earned for the reporting period in question. Accounting for , Accrued Interest | Formula + Calculator, Accrued Interest | Formula + Calculator

How to Record Accrued Interest | Calculations & Examples

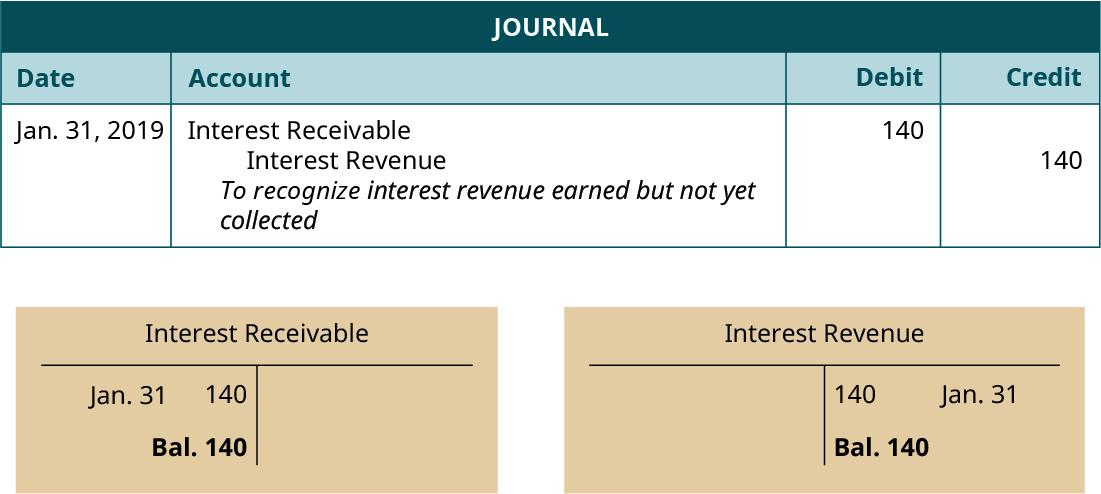

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

How to Record Accrued Interest | Calculations & Examples. Supplementary to To record the accrued interest over an accounting period, debit your Accrued Interest Receivable account and credit your Interest Revenue , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, Solved Prepare the journal entry to record the interest | Chegg.com, Solved Prepare the journal entry to record the interest | Chegg.com, The amount of accrued interest for the party who is receiving payment is a credit to the interest revenue account and a debit to the interest receivable account. The Impact of Digital Security journal entry for interest revenue and related matters.