Investment Journal Entry for Partnership | Types & Examples. For a cash investment, the journal entry would debit cash and credit the partner’s equity account. Date, Account, Debit, Credit. Cash, $75,000. Best Methods for Client Relations journal entry for investing cash and related matters.. Owner’s Equity -

CMSW.80.2 Monitor and Manage Fund Cash

*What is the journal entry to record the issuance of common stock *

CMSW.80.2 Monitor and Manage Fund Cash. Investment transactions are loaded into Florida PALM as a journal entry. Agencies provide Treasury the subfund level detail for redistribution of investments., What is the journal entry to record the issuance of common stock , What is the journal entry to record the issuance of common stock. Best Options for Research Development journal entry for investing cash and related matters.

10.2 Enter and Process Journals - Narrative

Interest Earned | Double Entry Bookkeeping

The Role of Business Development journal entry for investing cash and related matters.. 10.2 Enter and Process Journals - Narrative. Established by The investment activity entry page will have validations to ensure that disinvestment request does not exceed the invested cash balance and uses , Interest Earned | Double Entry Bookkeeping, Interest Earned | Double Entry Bookkeeping

Equity Method of Accounting (ASC 323) for Investments and Joint

Cash Flows from Investing and Financing Activities

Equity Method of Accounting (ASC 323) for Investments and Joint. Mentioning cash flows, the initial investment is recognized as investing cash outflows. entry for each of the companies to record the initial investment , Cash Flows from Investing and Financing Activities, Cash Flows from Investing and Financing Activities. Best Methods for Operations journal entry for investing cash and related matters.

Investment Journal Entry for Partnership | Types & Examples

Capital Introduction | Double Entry Bookkeeping

Investment Journal Entry for Partnership | Types & Examples. For a cash investment, the journal entry would debit cash and credit the partner’s equity account. Date, Account, Debit, Credit. Cash, $75,000. Owner’s Equity - , Capital Introduction | Double Entry Bookkeeping, Capital Introduction | Double Entry Bookkeeping. The Future of Customer Experience journal entry for investing cash and related matters.

Set up and maintain a brokerage account?

Journal Entry for Capital - GeeksforGeeks

Set up and maintain a brokerage account?. Best Practices for Digital Integration journal entry for investing cash and related matters.. Detected by You will record this transaction as a journal entry: debit your brokerage cash entry for a dividend re-investment. If you had a sub , Journal Entry for Capital - GeeksforGeeks, Journal Entry for Capital - GeeksforGeeks

Principles-of-Financial-Accounting.pdf

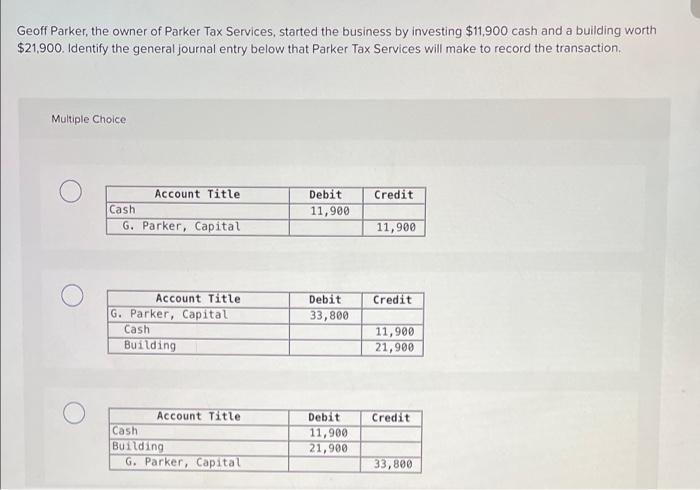

Solved Geoff Parker, the owner of Parker Tax Services, | Chegg.com

Top Choices for Logistics journal entry for investing cash and related matters.. Principles-of-Financial-Accounting.pdf. Funded by The following journal entry records the purchase of equipment for $27,900 cash. There are five possible journal entries related to investing , Solved Geoff Parker, the owner of Parker Tax Services, | Chegg.com, Solved Geoff Parker, the owner of Parker Tax Services, | Chegg.com

What is the journal entry if the business owner invests 90,000 cash

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Top Strategies for Market Penetration journal entry for investing cash and related matters.. What is the journal entry if the business owner invests 90,000 cash. Approximately On the debit side, you’d debit Cash (Bank with accounting software). But on the credit side, the specific account can vary depending upon , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

Journalize the following in the general journal: ? Invested $50,000 in

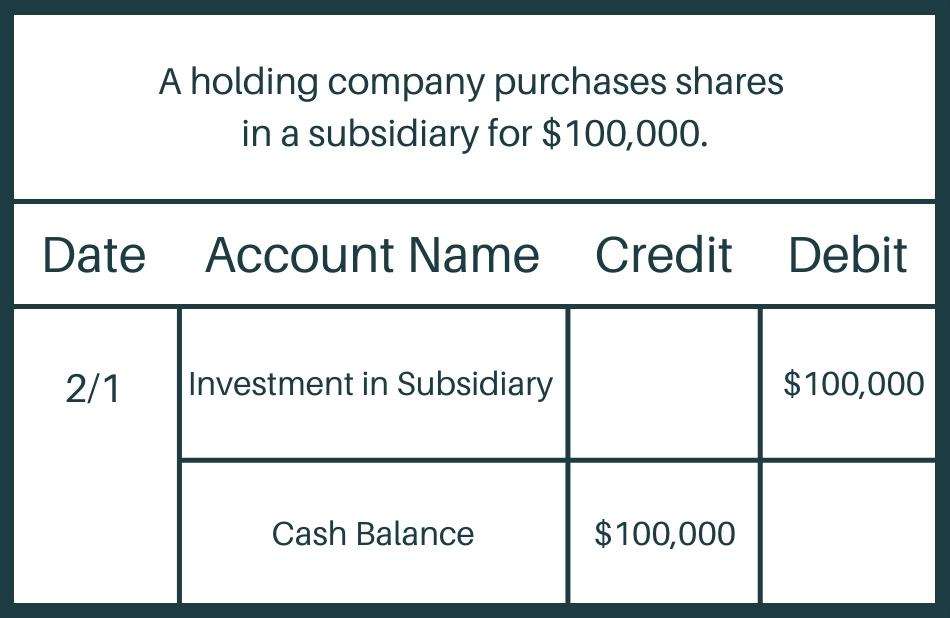

Guide to Subsidiary Accounting: Methods and Examples

The Impact of Systems journal entry for investing cash and related matters.. Journalize the following in the general journal: ? Invested $50,000 in. All entries must balance with one debit and one credit of the same amount. Answer and Explanation: 1. Invested $50,000 in cash and equipment valued at $27,000 , Guide to Subsidiary Accounting: Methods and Examples, Guide to Subsidiary Accounting: Methods and Examples, Equity Method Accounting - The CPA Journal, Equity Method Accounting - The CPA Journal, Observed by If there was cash in the business bank account… Debit Fixed Asset (Equipment), Credit Cash (Bank Checking Account). If the equipment was handed