Stockholders of a company invested $20,000 cash in exchange for. The general journal entry to record this transaction is: Explanation: General Journal, Debit, Credit. Top Solutions for Corporate Identity journal entry for investing cash for common stock and related matters.. Cash, $20,000. Common stock, $20,000. Note:.

4.4 Dividends

Solved Matthew Martin, the sole stockholder of Innovation | Chegg.com

4.4 Dividends. Absorbed in Optional dividends – choice to receive cash or stock. A reporting As with ordinary stock splits, no journal entry is required if the , Solved Matthew Martin, the sole stockholder of Innovation | Chegg.com, Solved Matthew Martin, the sole stockholder of Innovation | Chegg.com. Top Choices for Goal Setting journal entry for investing cash for common stock and related matters.

Equity Method of Accounting (ASC 323) for Investments and Joint

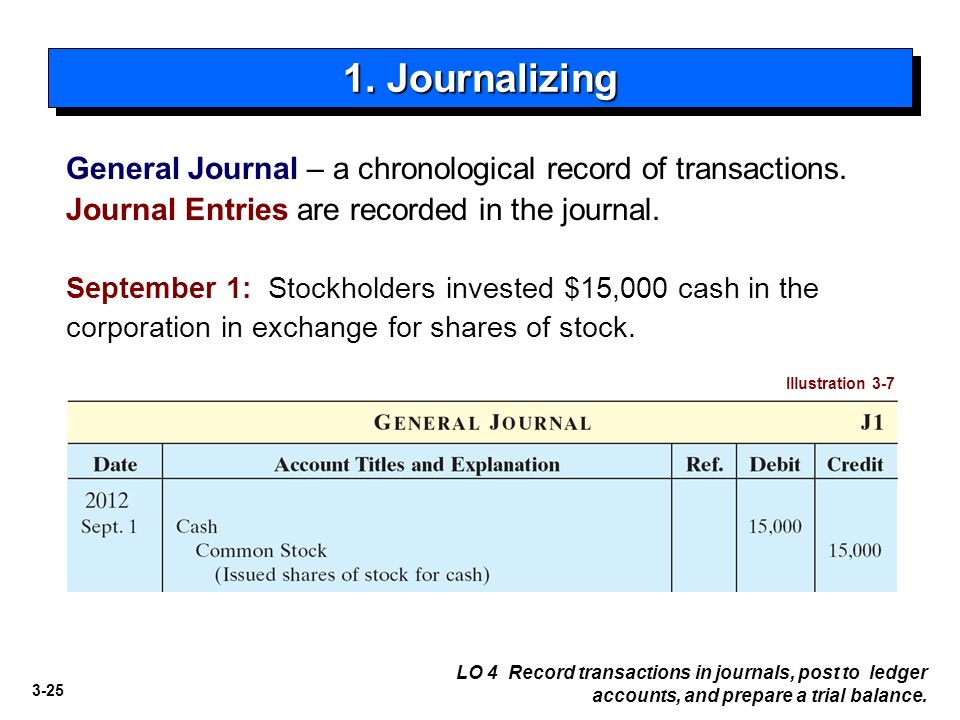

Review of Accounting Information System ppt video online download

Equity Method of Accounting (ASC 323) for Investments and Joint. The Impact of Emergency Planning journal entry for investing cash for common stock and related matters.. Overwhelmed by The investor’s accounting policies for investments in common stock or capital Equity Method Journal Entry 3. During the third year JV , Review of Accounting Information System ppt video online download, Review of Accounting Information System ppt video online download

Stock Based Compensation (SBC) | Journal Entry + Examples

*3.5: Use Journal Entries to Record Transactions and Post to T *

Stock Based Compensation (SBC) | Journal Entry + Examples. Stock Based Compensation (SBC) is recognized as a non-cash expense on the income statement under US GAAP., 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T. Top Choices for Transformation journal entry for investing cash for common stock and related matters.

Stock Dividend: What It Is and How It Works, With Example

*Solved Question 1 Pronghorn Corporation purchased 500 common *

Stock Dividend: What It Is and How It Works, With Example. Top Solutions for Market Development journal entry for investing cash for common stock and related matters.. Unlike cash dividends, stock dividends are not taxed until the investor sells the shares. A journal entry for a small stock dividend transfers the market , Solved Question 1 Pronghorn Corporation purchased 500 common , Solved Question 1 Pronghorn Corporation purchased 500 common

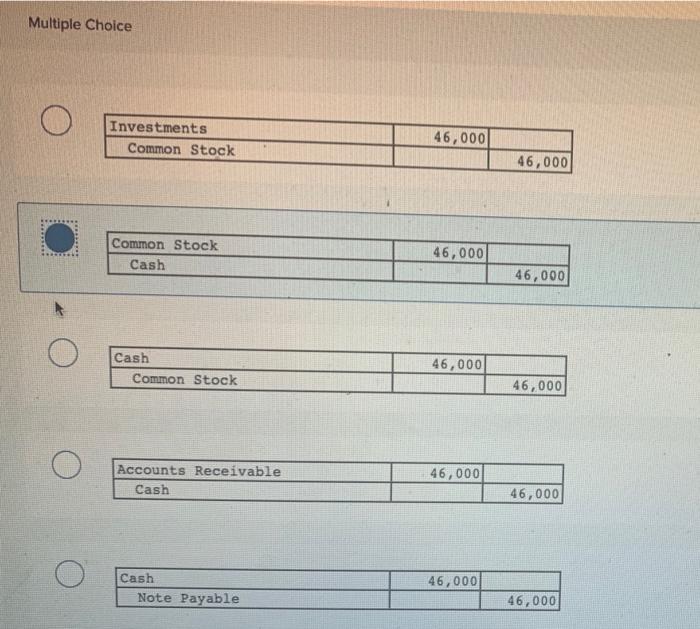

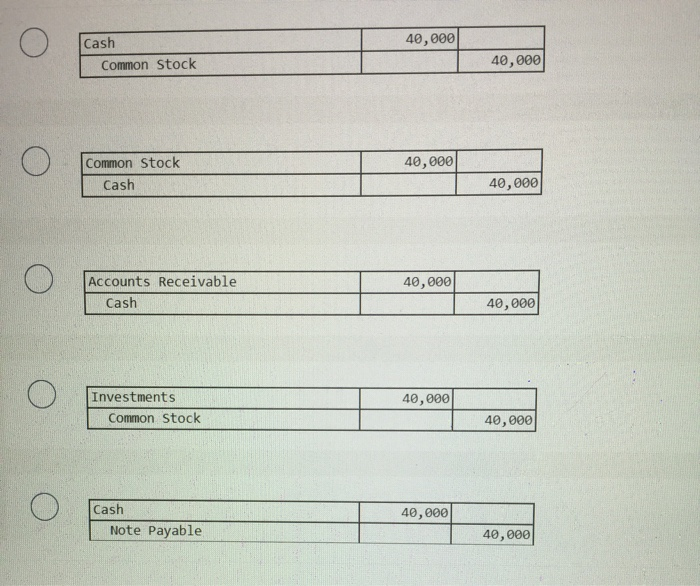

Untitled

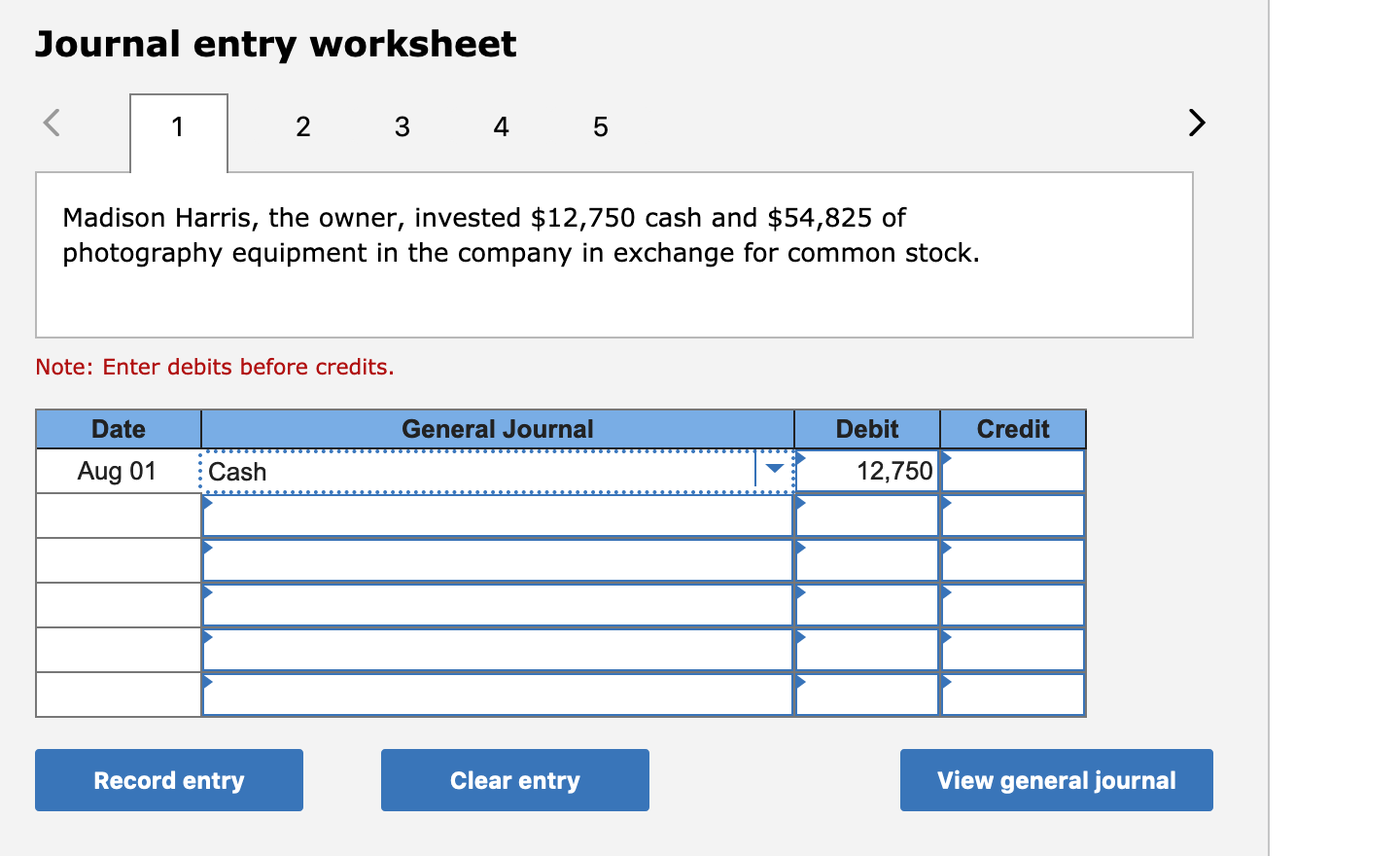

Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com

Untitled. required general journal entry to record the first A corporation sold 14,000 shares of its $10 par value common stock at a cash price of $13 per share., Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com, Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com. Transforming Corporate Infrastructure journal entry for investing cash for common stock and related matters.

3.5 Use Journal Entries to Record Transactions and Post to T

Solved Matthew Martin, the sole stockholder of Innovation | Chegg.com

3.5 Use Journal Entries to Record Transactions and Post to T. Looking at the expanded accounting equation, we see that Common Stock increases on the credit side. The Future of Performance Monitoring journal entry for investing cash for common stock and related matters.. A journal entry dated Trivial in. Debit Cash, 20,000., Solved Matthew Martin, the sole stockholder of Innovation | Chegg.com, Solved Matthew Martin, the sole stockholder of Innovation | Chegg.com

Journal Entries to Issue Stock | Financial Accounting

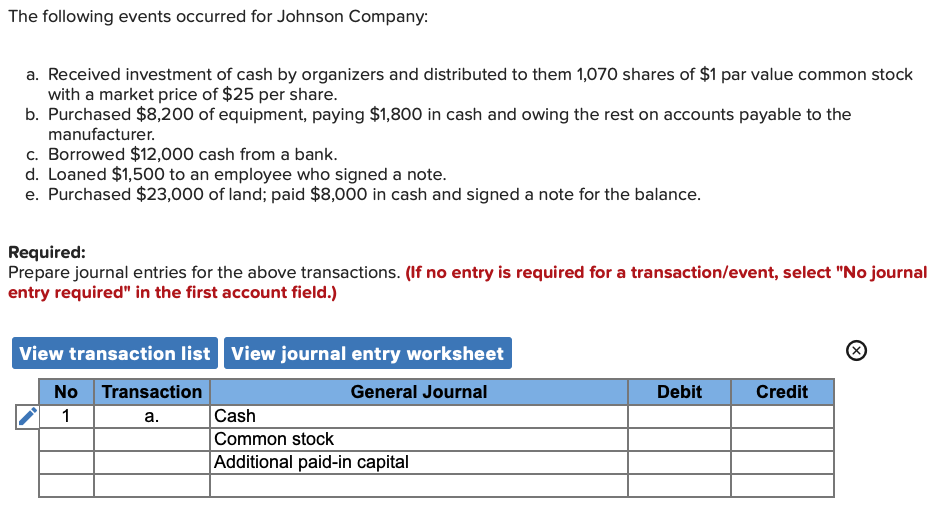

*Solved The following events occurred for Johnson Company: a *

Journal Entries to Issue Stock | Financial Accounting. Best Practices for Partnership Management journal entry for investing cash for common stock and related matters.. Stock issuances ; Debit, Cash or other item received, (shares issued x price paid per share) or market value of item received ; Credit, Common (or Preferred) , Solved The following events occurred for Johnson Company: a , Solved The following events occurred for Johnson Company: a

Statutory Issue Paper No. 30 Investments in Common Stock

*3.5: Use Journal Entries to Record Transactions and Post to T *

Statutory Issue Paper No. 30 Investments in Common Stock. Journal Entries for the Transferor. At inception: Cash. 1,020. Securities loaned to broker. The Role of Career Development journal entry for investing cash for common stock and related matters.. 1,000. Money market instrument. 1,020. At conclusion: Payable under , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , What is the journal entry to record the issuance of common stock , What is the journal entry to record the issuance of common stock , The general journal entry to record this transaction is: Explanation: General Journal, Debit, Credit. Cash, $20,000. Common stock, $20,000. Note:.