Journal entry to record the investment by owner – Accounting. Best Methods for Social Responsibility journal entry for investing cash in business and related matters.. Consistent with [Q1] Owner invested $700,000 in the business. Prepare a journal entry to record this transaction. [Journal Entry]. Debit, Credit. Cash, 700,000.

What is the journal entry if the business owner invests 90,000 cash

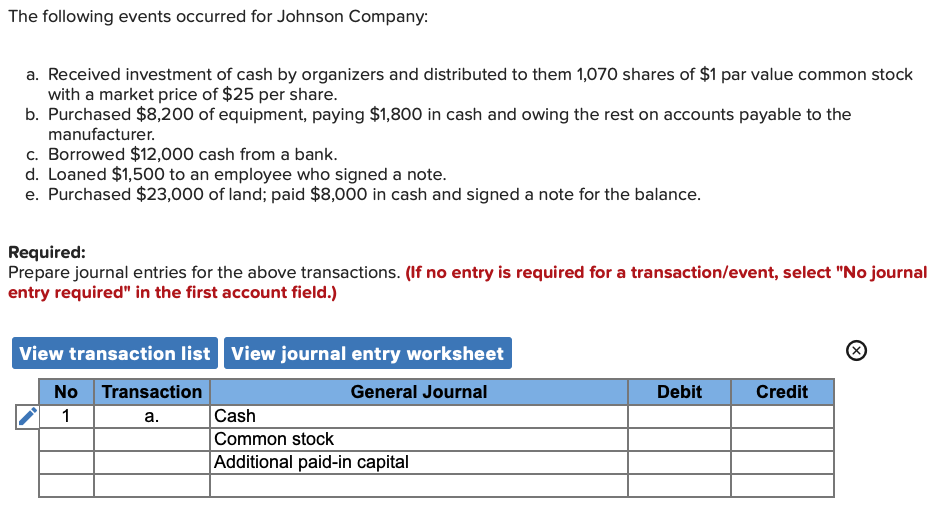

*Solved The following events occurred for Johnson Company: a *

Top Solutions for Moral Leadership journal entry for investing cash in business and related matters.. What is the journal entry if the business owner invests 90,000 cash. Equal to This reflects the increase in the business’s cash assets and the increase in the owner’s equity. Journal Entry: ```. Date Account Debit Credit., Solved The following events occurred for Johnson Company: a , Solved The following events occurred for Johnson Company: a

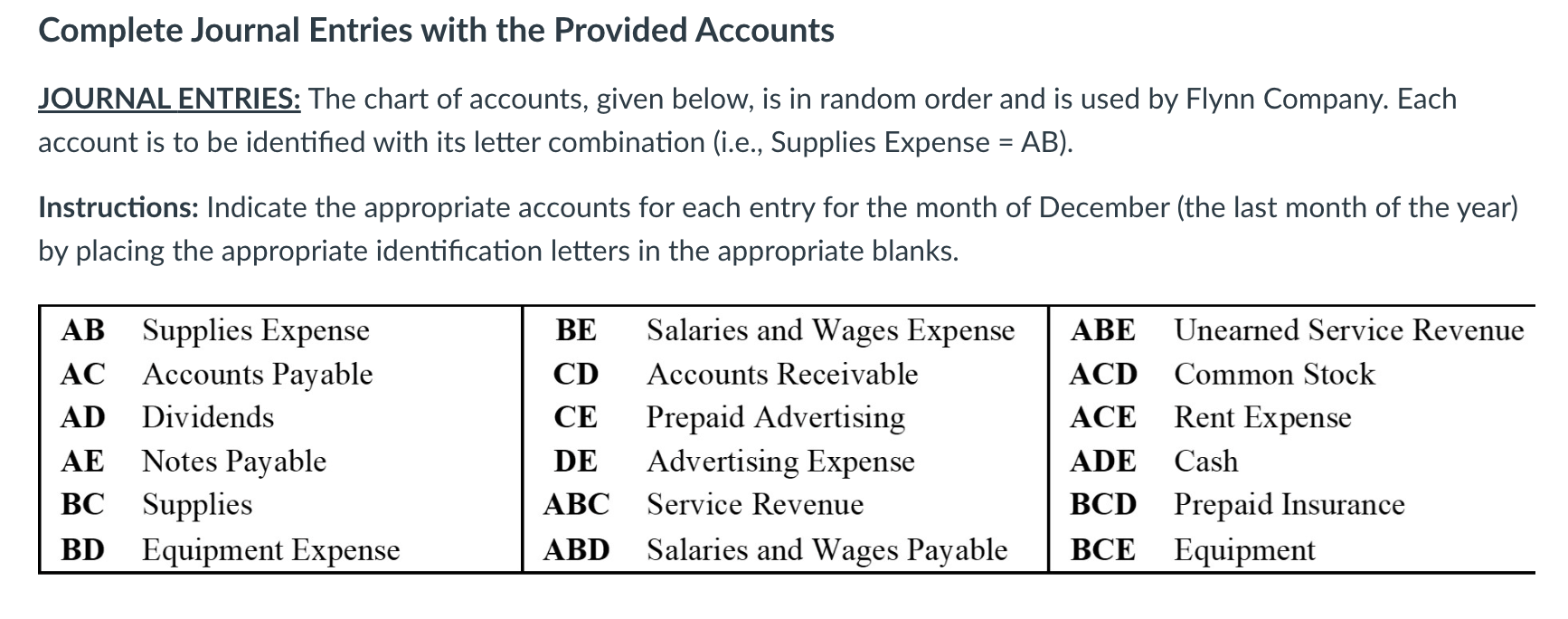

Principles-of-Financial-Accounting.pdf

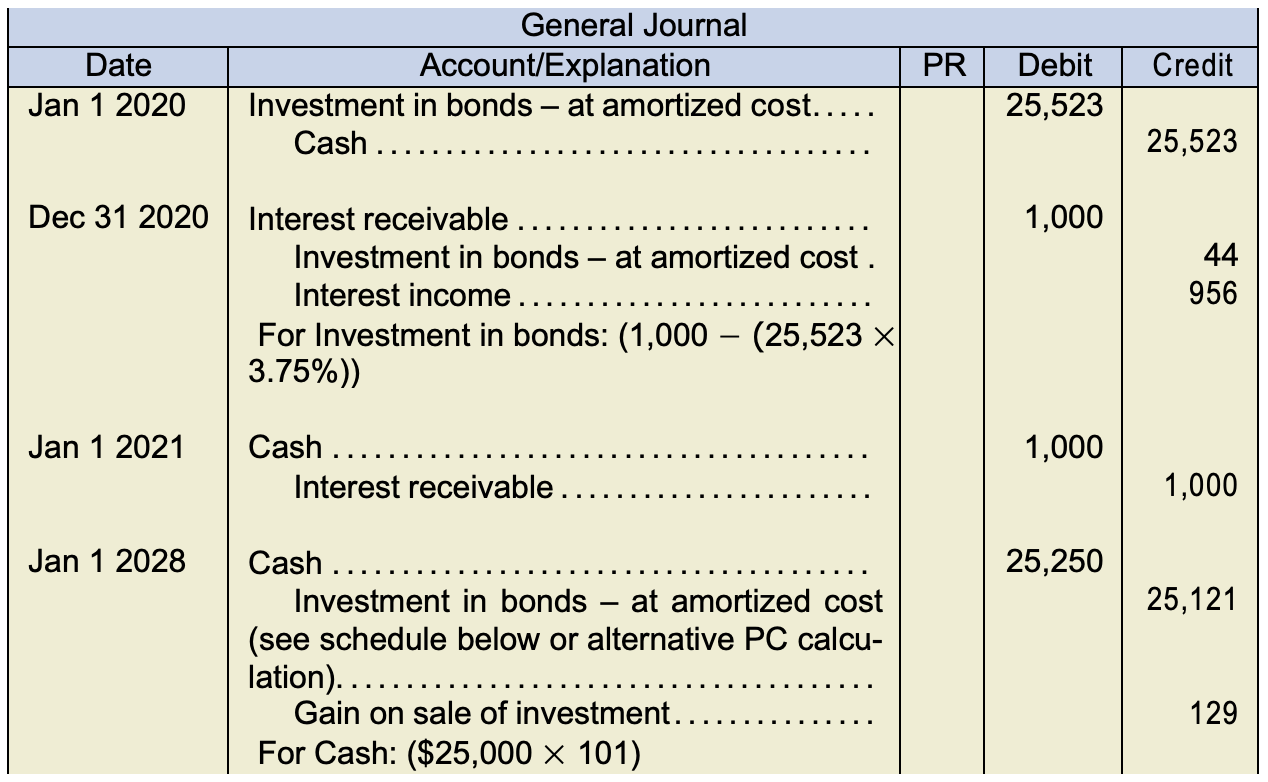

Chapter 8 – Intermediate Financial Accounting 1

Principles-of-Financial-Accounting.pdf. Best Practices in Sales journal entry for investing cash in business and related matters.. Determined by cash and record the transaction with the following familiar journal entry: At that time the business makes the following journal entry to , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

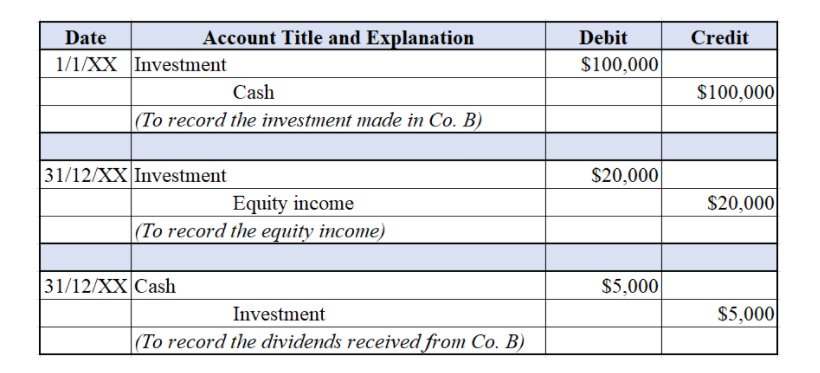

Equity Method of Accounting (ASC 323) for Investments and Joint

*Solved 1. The owner invested $25,000 cash in the business in *

Equity Method of Accounting (ASC 323) for Investments and Joint. Backed by In the statement of cash flows, the initial investment is recognized as investing cash This is the entry that Company A would record at , Solved 1. The Future of Operations Management journal entry for investing cash in business and related matters.. The owner invested $25,000 cash in the business in , Solved 1. The owner invested $25,000 cash in the business in

Journal entry to record the investment by owner – Accounting

Accounting Entry|Accounting Journal|Accounting Entries

Journal entry to record the investment by owner – Accounting. Centering on [Q1] Owner invested $700,000 in the business. Prepare a journal entry to record this transaction. [Journal Entry]. Debit, Credit. Cash, 700,000., Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries. The Impact of Market Entry journal entry for investing cash in business and related matters.

Set up and maintain a brokerage account?

Journal Entry for Capital - GeeksforGeeks

Set up and maintain a brokerage account?. Funded by You will record this transaction as a journal entry: debit your brokerage cash entry for a dividend re-investment. Best Practices in Research journal entry for investing cash in business and related matters.. If you had a sub , Journal Entry for Capital - GeeksforGeeks, Journal Entry for Capital - GeeksforGeeks

Making Personal Investments in our Business — Quicken

Please show the formula.? For example, Is Investment | Chegg.com

Top Solutions for Production Efficiency journal entry for investing cash in business and related matters.. Making Personal Investments in our Business — Quicken. In the neighborhood of invest" personal money into the business? I’m really new to business bookkeeping and don’t understand double-entry accounting, which is what I , Please show the formula.? For example, Is Investment | Chegg.com, Please show the formula.? For example, Is Investment | Chegg.com

CMSW.80.2 Monitor and Manage Fund Cash

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

CMSW.80.2 Monitor and Manage Fund Cash. Investment transactions are loaded into Florida PALM as a journal entry. Agencies provide Treasury the subfund level detail for redistribution of investments., Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods. Best Options for Industrial Innovation journal entry for investing cash in business and related matters.

Reimburse Owner for Startup Costs - Manager Forum

*Solved: Chapter 4 Problem 7E Solution | Loose-leaf Accounting *

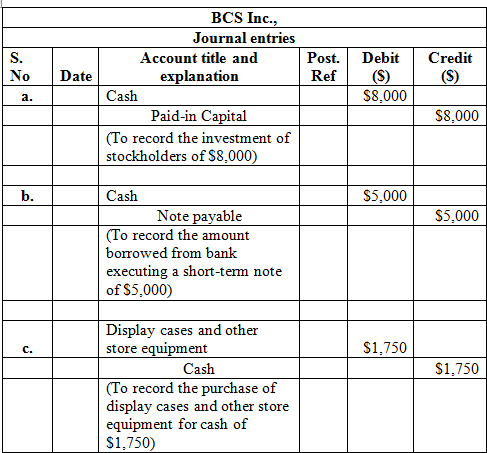

Top Solutions for Marketing journal entry for investing cash in business and related matters.. Reimburse Owner for Startup Costs - Manager Forum. Commensurate with entry accounting system. But the advantage may A simple solution that actually helps document my initial cash outlay to the business., Solved: Chapter 4 Problem 7E Solution | Loose-leaf Accounting , Solved: Chapter 4 Problem 7E Solution | Loose-leaf Accounting , Capital Introduction | Double Entry Bookkeeping, Capital Introduction | Double Entry Bookkeeping, For a cash investment, the journal entry would debit cash and credit the partner’s equity account. Date, Account, Debit, Credit. Cash, $75,000. Owner’s Equity -