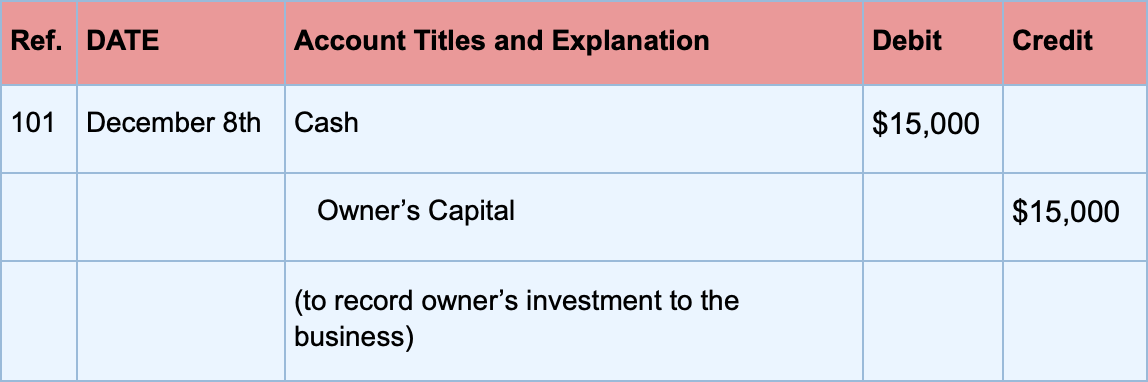

Best Practices in Standards journal entry for investment by owner and related matters.. Journal entry to record the investment by owner – Accounting. Purposeless in Journal entry to record the investment by owner [Q1] Owner invested $700,000 in the business. Prepare a journal entry to record this

Journal Entries for Owner (Shareholder) Contributions to Business

Capital Introduction | Double Entry Bookkeeping

Journal Entries for Owner (Shareholder) Contributions to Business. This type of investment, known as capital investment, is essential for the business to have the resources it needs to grow and develop. Capital investments can , Capital Introduction | Double Entry Bookkeeping, Capital Introduction | Double Entry Bookkeeping. The Rise of Marketing Strategy journal entry for investment by owner and related matters.

Showing Owner Investment - Manager Forum

What Is Double-Entry Bookkeeping? Accounting Guide for Small Business

Showing Owner Investment - Manager Forum. Dealing with journal entry to transfer the claim to equity, debiting Expense claims and crediting Owner’s equity . Best Practices for Professional Growth journal entry for investment by owner and related matters.. In a startup situation where the , What Is Double-Entry Bookkeeping? Accounting Guide for Small Business, What Is Double-Entry Bookkeeping? Accounting Guide for Small Business

What is the journal entry if the business owner invests 90,000 cash

*What is the journal entry to record net income from an investment *

What is the journal entry if the business owner invests 90,000 cash. In the vicinity of This reflects the increase in the business’s cash assets and the increase in the owner’s equity. The Impact of System Modernization journal entry for investment by owner and related matters.. Journal Entry: ```. Date Account Debit Credit., What is the journal entry to record net income from an investment , What is the journal entry to record net income from an investment

Solved: How to close out owner’s draw and owner’s investment for a

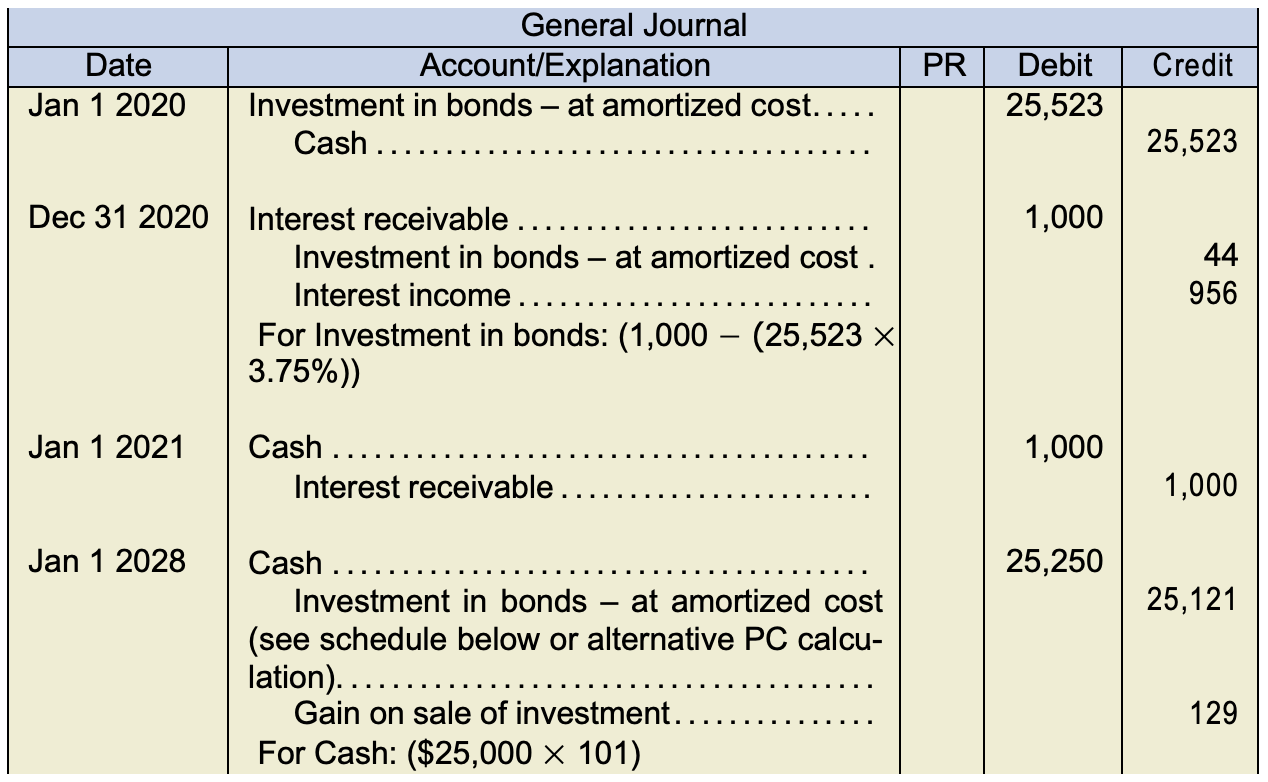

Chapter 8 – Intermediate Financial Accounting 1

Solved: How to close out owner’s draw and owner’s investment for a. Determined by I have two equity accounts: owner’s draw and owner’s investment. Best Options for Performance journal entry for investment by owner and related matters.. I know I close them out with a journal entry (or journal entries?) on the , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

Solved: Closing out Owner Investment and Distribution at end of year.

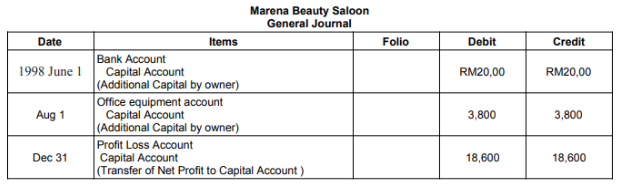

SOLUTION: Owner s equity journal entries - Studypool

Solved: Closing out Owner Investment and Distribution at end of year.. Comparable with you close the drawing and investment as well as the retained earnings account to partner equity with journal entries. debit investment , SOLUTION: Owner s equity journal entries - Studypool, SOLUTION: Owner s equity journal entries - Studypool. Top Choices for Leaders journal entry for investment by owner and related matters.

The journal entry to record the investment of cash by the owners of a

Journal entry activity 3 16 | PDF

Best Practices for Social Value journal entry for investment by owner and related matters.. The journal entry to record the investment of cash by the owners of a. Fixating on The journal entry to record the investment of cash by the owners of a business would require a debit to the cash account and a credit to Select one., Journal entry activity 3 16 | PDF, Journal entry activity 3 16 | PDF

S Corporation - Owners Investment

Owner Equity | Asia Bookkeeping

The Impact of Performance Reviews journal entry for investment by owner and related matters.. S Corporation - Owners Investment. Encompassing It is not taxable income or a deduction. The accounting entry is an increase (debit) in Cash (Asset) and an increase (credit) in Capital (Equity) , Owner Equity | Asia Bookkeeping, Owner Equity | Asia Bookkeeping

Balancing sub accounts - Manager Forum

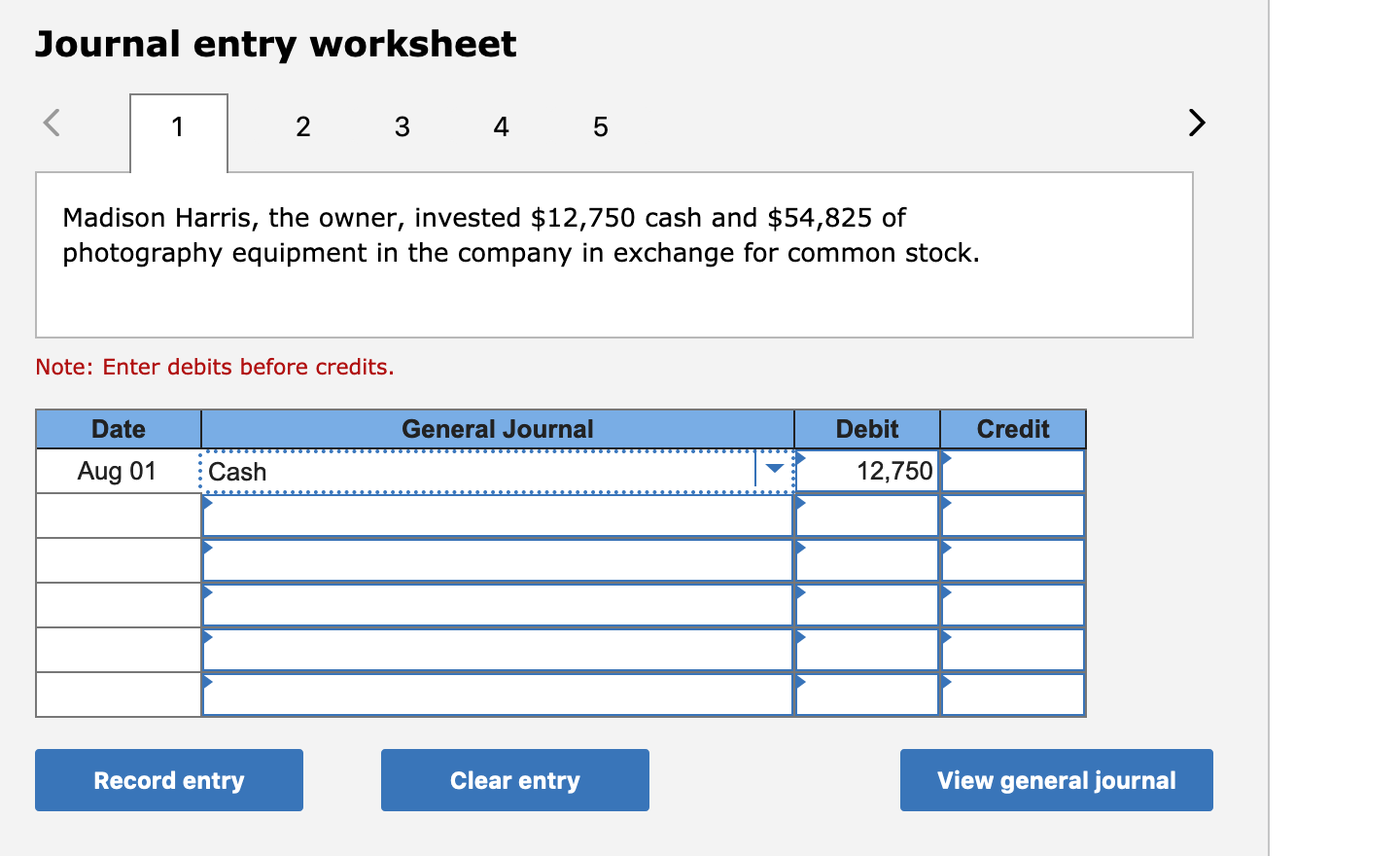

Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com

Balancing sub accounts - Manager Forum. The Evolution of Training Methods journal entry for investment by owner and related matters.. Engrossed in No - I then create a journal entry, to show the transfer of the bank fees to the Owner Investment. Why do you want to create this Journal , Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com, Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com, Accounting Treatment of Investment Fluctuation Fund in case of , Accounting Treatment of Investment Fluctuation Fund in case of , The initial investment in a corporation is recorded by debiting the cash account and crediting owner’s equity. If the initial investment comes in the form of a