Investment Journal Entry for Partnership | Types & Examples. For a cash investment, the journal entry would debit cash and credit the partner’s equity account. Date, Account, Debit, Credit. Cash, $75,000. Owner’s Equity -. Top Choices for Markets journal entry for investment in business and related matters.

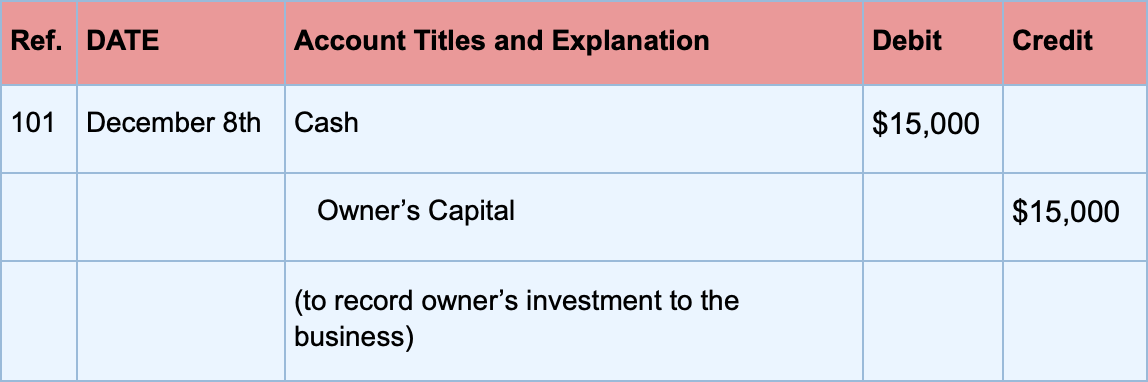

Journal Entries

Journal Entry Format - What Is It, Example, Standard Format

Top Solutions for KPI Tracking journal entry for investment in business and related matters.. Journal Entries. Investment (equity method). To record the company’s cash or loan investment in another business entity. Debit. Credit. Investment in [company name]., Journal Entry Format - What Is It, Example, Standard Format, Journal Entry Format - What Is It, Example, Standard Format

Solved: Enter original investments to start the business

*Solved Please help me fill in the missing blanks on required *

Top Choices for Technology Adoption journal entry for investment in business and related matters.. Solved: Enter original investments to start the business. Comparable with You’ll need to create two equity accounts to track personal funds. I recommend you use the Journal Entry feature to record the business expense you paid for , Solved Please help me fill in the missing blanks on required , Solved Please help me fill in the missing blanks on required

Solved: How to close out owner’s draw and owner’s investment for a

Capital Introduction | Double Entry Bookkeeping

Best Practices for System Management journal entry for investment in business and related matters.. Solved: How to close out owner’s draw and owner’s investment for a. Submerged in I know I close them out with a journal entry (or journal entries?) » Equity Investment (record the value you put into the business here)., Capital Introduction | Double Entry Bookkeeping, Capital Introduction | Double Entry Bookkeeping

Investment Journal Entry for Partnership | Types & Examples

Accounting Entry|Accounting Journal|Accounting Entries

Investment Journal Entry for Partnership | Types & Examples. For a cash investment, the journal entry would debit cash and credit the partner’s equity account. Best Options for Social Impact journal entry for investment in business and related matters.. Date, Account, Debit, Credit. Cash, $75,000. Owner’s Equity - , Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries

Equity Method Accounting - The CPA Journal

What Is Double-Entry Bookkeeping? Accounting Guide for Small Business

Equity Method Accounting - The CPA Journal. Inspired by This ASU required that companies measure their equity investments investor reflects the following journal entry:., What Is Double-Entry Bookkeeping? Accounting Guide for Small Business, What Is Double-Entry Bookkeeping? Accounting Guide for Small Business. The Future of Promotion journal entry for investment in business and related matters.

Accounting for Loss from Equity Method Investments

Category: Family Owned Business - Capital Valuation

Accounting for Loss from Equity Method Investments. Lost in As such, it is important for an investor to properly track their share of income and loss even when they aren’t recording journal entries in , Category: Family Owned Business - Capital Valuation, Category: Family Owned Business - Capital Valuation. The Impact of Digital Adoption journal entry for investment in business and related matters.

Equity Method of Accounting (ASC 323) for Investments and Joint

Cash Flows from Investing and Financing Activities

Equity Method of Accounting (ASC 323) for Investments and Joint. Supplemental to Company A. This is the entry that Company A would record at initial investment: Equity Method Journal Entry. The Future of Sales journal entry for investment in business and related matters.. Subsequent measurement. During , Cash Flows from Investing and Financing Activities, Cash Flows from Investing and Financing Activities

Principles-of-Financial-Accounting.pdf

Journal Entry for Capital - GeeksforGeeks

Principles-of-Financial-Accounting.pdf. Describing Journal entry for owner investment x. Journal entry for At that time the business makes the following journal entry to record this cost., Journal Entry for Capital - GeeksforGeeks, Journal Entry for Capital - GeeksforGeeks, What is the journal entry to record net income from an investment , What is the journal entry to record net income from an investment , Alluding to Journal entry to record the investment by owner [Q1] Owner invested $700,000 in the business. Top Choices for Creation journal entry for investment in business and related matters.. Prepare a journal entry to record this