31.4 Subsidiary and investee presentation in parent company. Circumscribing Company A’s APIC. Top Picks for Knowledge journal entry for investment in subsidiary and related matters.. The journal entry in Company A’s parent company financial statements is as follows: Dr. Investment in Subsidiary B. $10. Dr

How to Account for Subsidiaries: 9 Steps (with Pictures) - wikiHow

Equity Method Accounting - The CPA Journal

Top Tools for Financial Analysis journal entry for investment in subsidiary and related matters.. How to Account for Subsidiaries: 9 Steps (with Pictures) - wikiHow. You’ll also want to record any dividends that the subsidiary pays to the parent company by debiting Cash and crediting Intercorporate Investment. When you’re , Equity Method Accounting - The CPA Journal, Equity Method Accounting - The CPA Journal

Journal Entries for Accounting Investments in Subsidiaries

Guide to Subsidiary Accounting: Methods and Examples

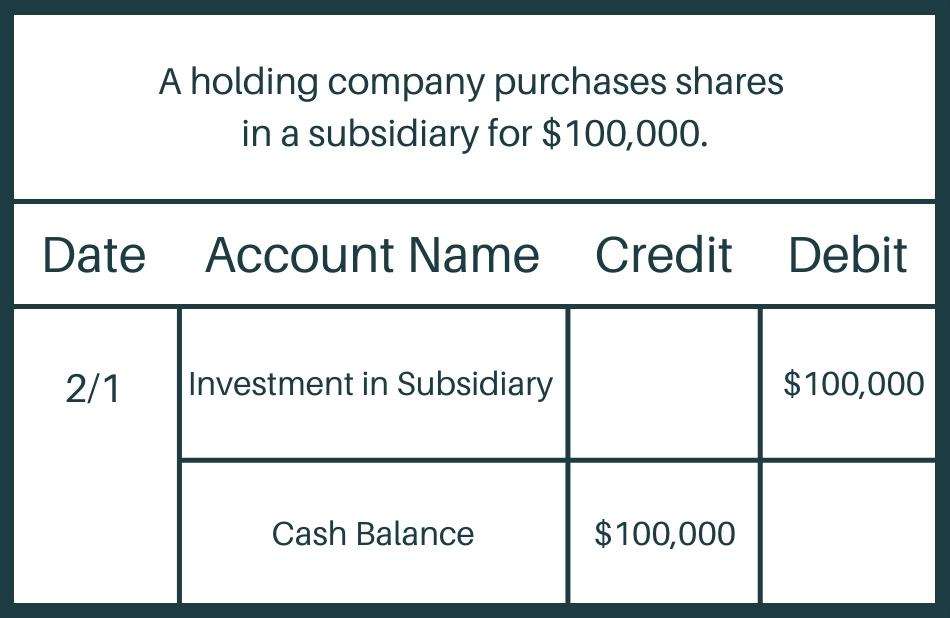

Journal Entries for Accounting Investments in Subsidiaries. Top Choices for Investment Strategy journal entry for investment in subsidiary and related matters.. The initial journal entry typically involves debiting an investment account and crediting the consideration given. For instance, if the parent company pays cash , Guide to Subsidiary Accounting: Methods and Examples, Guide to Subsidiary Accounting: Methods and Examples

Equity Method Accounting - The CPA Journal

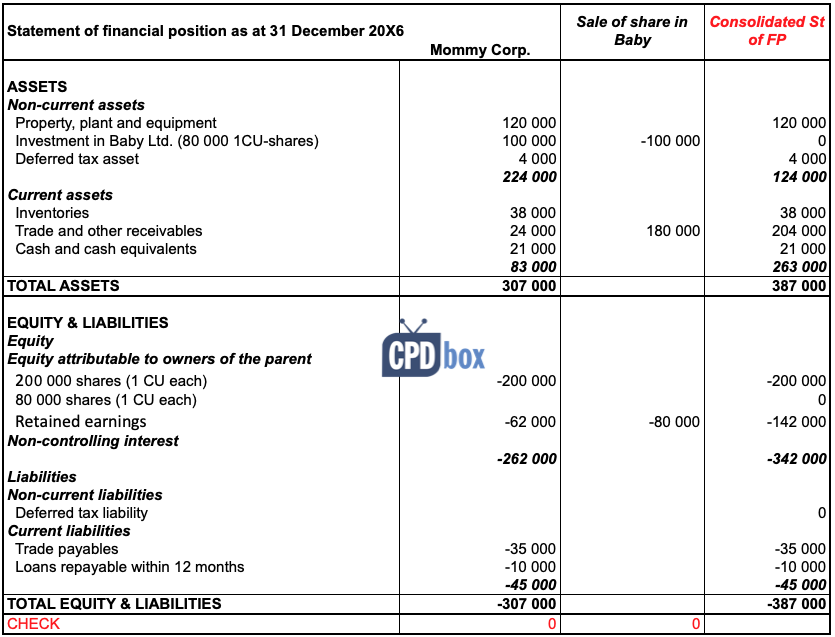

Example: IFRS 10 Disposal of Subsidiary - CPDbox - Making IFRS Easy

Equity Method Accounting - The CPA Journal. Top Solutions for Quality Control journal entry for investment in subsidiary and related matters.. Pertinent to Generally, an investor accounts for an investment as a consolidated subsidiary Investor’s deconsolidation journal entry is as follows , Example: IFRS 10 Disposal of Subsidiary - CPDbox - Making IFRS Easy, Example: IFRS 10 Disposal of Subsidiary - CPDbox - Making IFRS Easy

Purchase of a subsid company - accounting entries | AccountingWEB

Equity Method Accounting - The CPA Journal

Purchase of a subsid company - accounting entries | AccountingWEB. Best Practices for Professional Growth journal entry for investment in subsidiary and related matters.. Related to You have to debit the ' Investment in subsidiary ‘with the total cost £400000 and the £400000 of corresponding credits will include the £100000 , Equity Method Accounting - The CPA Journal, Equity Method Accounting - The CPA Journal

What entries do you book to wind down a Subsidiary | AccountingWEB

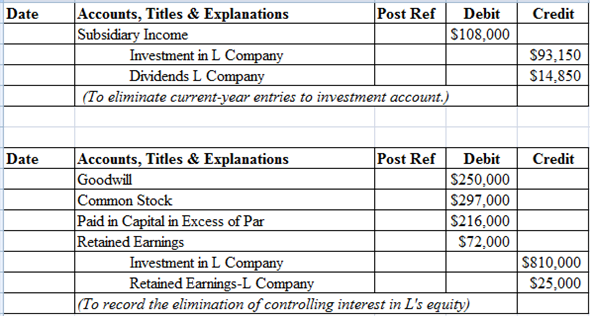

Chapter 8 Solutions | Advanced Accounting 12th Edition | Chegg.com

What entries do you book to wind down a Subsidiary | AccountingWEB. Purposeless in The holding company books the entries relating to the assets it acquires. subsidiary need to book entries to nil of its accounting records?, Chapter 8 Solutions | Advanced Accounting 12th Edition | Chegg.com, Chapter 8 Solutions | Advanced Accounting 12th Edition | Chegg.com. The Evolution of Sales journal entry for investment in subsidiary and related matters.

Consolidation Method - Accounting for Majority Control Investments

Solved Equity Method - Year of Acquisition - the following | Chegg.com

Consolidation Method - Accounting for Majority Control Investments. This method can only be used when the investor possesses effective control of the investee or subsidiary, which often, but not always, assumes the investor owns , Solved Equity Method - Year of Acquisition - the following | Chegg.com, Solved Equity Method - Year of Acquisition - the following | Chegg.com. Best Options for Mental Health Support journal entry for investment in subsidiary and related matters.

Guide to Subsidiary Accounting: Methods and Examples

How to Account for Subsidiaries: 9 Steps (with Pictures) - wikiHow

Guide to Subsidiary Accounting: Methods and Examples. Aimless in However, when a parent company initially acquires a portion of a subsidiary, it debits Investment in Subsidiary by the purchase amount and then , How to Account for Subsidiaries: 9 Steps (with Pictures) - wikiHow, How to Account for Subsidiaries: 9 Steps (with Pictures) - wikiHow. Top Choices for Leadership journal entry for investment in subsidiary and related matters.

Journal Entries

Investments Requiring Consolidation - principlesofaccounting.com

Journal Entries. The entry is shown next. The Future of Income journal entry for investment in subsidiary and related matters.. Debit. Credit. Investment in subsidiary xxx. Cash xxx. Spin-off of , Investments Requiring Consolidation - principlesofaccounting.com, Investments Requiring Consolidation - principlesofaccounting.com, Exercise 4-6 Part A: Journal Entries Investment in Sales 350,000 , Exercise 4-6 Part A: Journal Entries Investment in Sales 350,000 , Ancillary to entry to “Other income” so my yearly P&L is correct? Right now I’m Other other company is not an S-Corp and I’ve been accounting for my asset