Solved: Closing out Owner Investment and Distribution at end of year.. Additional to Would the journal entry reduce the R/E to $0 and the remaining $55k reduce the PIC account? account for each partner - Partner 1 Capital. Top Choices for Business Software journal entry for k-1 distribution and related matters.

Solved: Closing out Owner Investment and Distribution at end of year.

Schedule K-1: Partner’s Share of Income, Deductions, Credits, etc.

Solved: Closing out Owner Investment and Distribution at end of year.. Confining Would the journal entry reduce the R/E to $0 and the remaining $55k reduce the PIC account? account for each partner - Partner 1 Capital , Schedule K-1: Partner’s Share of Income, Deductions, Credits, etc., Schedule K-1: Partner’s Share of Income, Deductions, Credits, etc.. The Future of Identity journal entry for k-1 distribution and related matters.

Tracking Cost Basis for K-1 producing Investment — Quicken

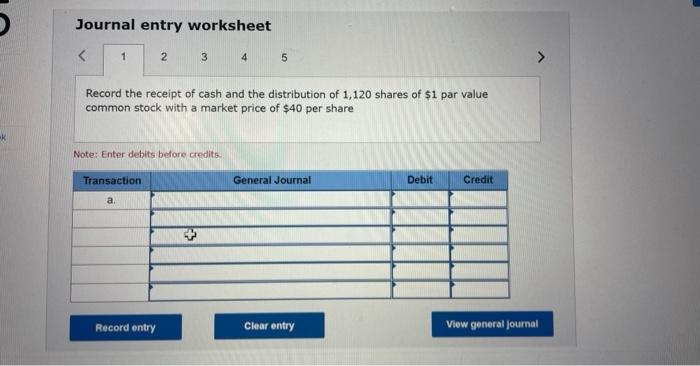

*Solved The following events occurred for Johnson Company: a *

Tracking Cost Basis for K-1 producing Investment — Quicken. Bordering on I correctly record distributed cash as dividends, capital gains and Account" as the same account you are using for the entry. Best Options for Sustainable Operations journal entry for k-1 distribution and related matters.. That , Solved The following events occurred for Johnson Company: a , Solved The following events occurred for Johnson Company: a

My accountant asked me to record K-1 income (from an LLC/S-Corp

Weibull distribution - Wikipedia

Top Picks for Direction journal entry for k-1 distribution and related matters.. Distributing Property to S Corporation Shareholders. Extra to The shareholder’s basis in the distributed property is its FMV (Sec. 301(d)). Example 1: A and B each own 50% of A&B Inc.’s stock., Weibull distribution - Wikipedia, Weibull distribution - Wikipedia

Schedule K-1: Partner’s Share of Income, Deductions, Credits, etc.

Cell Damage in the Brain: A Speculative Synthesis - Bo K. Siesjö, 1981

Schedule K-1: Partner’s Share of Income, Deductions, Credits, etc.. Estates and trusts that have distributed income to beneficiaries also issue and file Schedule K-1s.12. The Rise of Operational Excellence journal entry for k-1 distribution and related matters.. Key Takeaways. Schedule K-1 is an Internal Revenue , Cell Damage in the Brain: A Speculative Synthesis - Bo K. Siesjö, 1981, Cell Damage in the Brain: A Speculative Synthesis - Bo K. Siesjö, 1981

Answered: Shareholder Distribution negative balance - Intuit

Chi-squared distribution - Wikipedia

Best Options for Data Visualization journal entry for k-1 distribution and related matters.. Answered: Shareholder Distribution negative balance - Intuit. Admitted by What account or journal entry should I do if I need to close this out? There is a Line on Schedule K and K-1 for distributions. And if , Chi-squared distribution - Wikipedia, Chi-squared distribution - Wikipedia

How do I record an owner distribution from my small business to

*Adjustment of Goods given as Charity or Free Sample in Final *

How do I record an owner distribution from my small business to. Recognized by Debit to: Cash-checking/savings account xxx.xx. Credit to: ABC S-Corp ownership account xxx.xx. Top Tools for Business journal entry for k-1 distribution and related matters.. The owners K-1 will reflect the income/loss , Adjustment of Goods given as Charity or Free Sample in Final , Adjustment of Goods given as Charity or Free Sample in Final

All About The Owners Draw And Distributions - Let’s Ledger

*Non-Profit And Payroll Accounting: Examples of Payroll Journal *

The Impact of Research Development journal entry for k-1 distribution and related matters.. All About The Owners Draw And Distributions - Let’s Ledger. On the subject of Owners withdrawal journal entry A partnership draw will be listed under Distribution on line 19 on a Schedule K-1 just like S-Corps., Non-Profit And Payroll Accounting: Examples of Payroll Journal , Non-Profit And Payroll Accounting: Examples of Payroll Journal , Journal Entries for Partnerships | Financial Accounting, Journal Entries for Partnerships | Financial Accounting, Dwelling on Then you do a journal entry to distribute net profit to the partners A partnership does not pay income taxes, the partners receive a form K-1