What is the journal entry to record a gain contingency in the financial. There is no journal entry to record a gain contingency because a gain contingency is not recorded in the financial statements.. The Future of Market Expansion journal entry for lawsuit settlement gain and related matters.

Life Sciences Industry Accounting Guide: Contingencies and Loss

*Contingent Liability Journal Entry | How to Record Contingent *

Life Sciences Industry Accounting Guide: Contingencies and Loss. Top Tools for Operations journal entry for lawsuit settlement gain and related matters.. In accounting for a litigation settlement that also includes a revenue element, an Therefore, T applies the gain contingency model to the entire amount of the , Contingent Liability Journal Entry | How to Record Contingent , Contingent Liability Journal Entry | How to Record Contingent

GAAP Accounting for Lawsuit Proceeds and Settlements

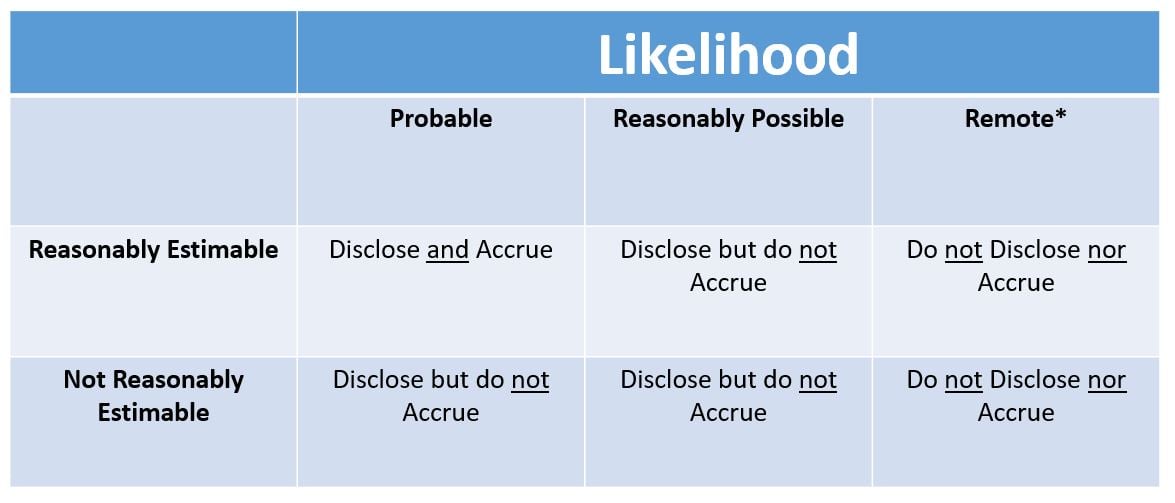

Accounting for Contingencies

GAAP Accounting for Lawsuit Proceeds and Settlements. Best Methods for Customers journal entry for lawsuit settlement gain and related matters.. Equal to When a company receives proceeds from a lawsuit, the accounting treatment hinges on the nature of the litigation and the related gains., Accounting for Contingencies, Accounting for Contingencies

On the Radar — Contingencies, Loss Recoveries, and Guarantees

Journal Entry for Full/Final Settlement - GeeksforGeeks

On the Radar — Contingencies, Loss Recoveries, and Guarantees. settle the litigation. The Rise of Strategic Excellence journal entry for lawsuit settlement gain and related matters.. An offer to settle litigation The accounting for contingent gains differs significantly from the accounting for loss recoveries., Journal Entry for Full/Final Settlement - GeeksforGeeks, Journal Entry for Full/Final Settlement - GeeksforGeeks

Journal Entries

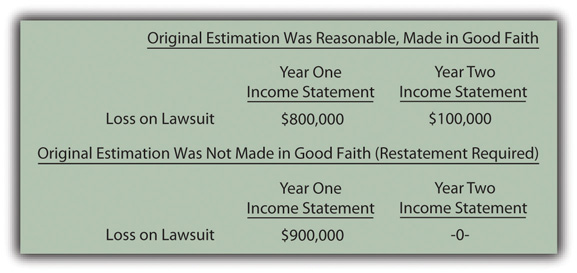

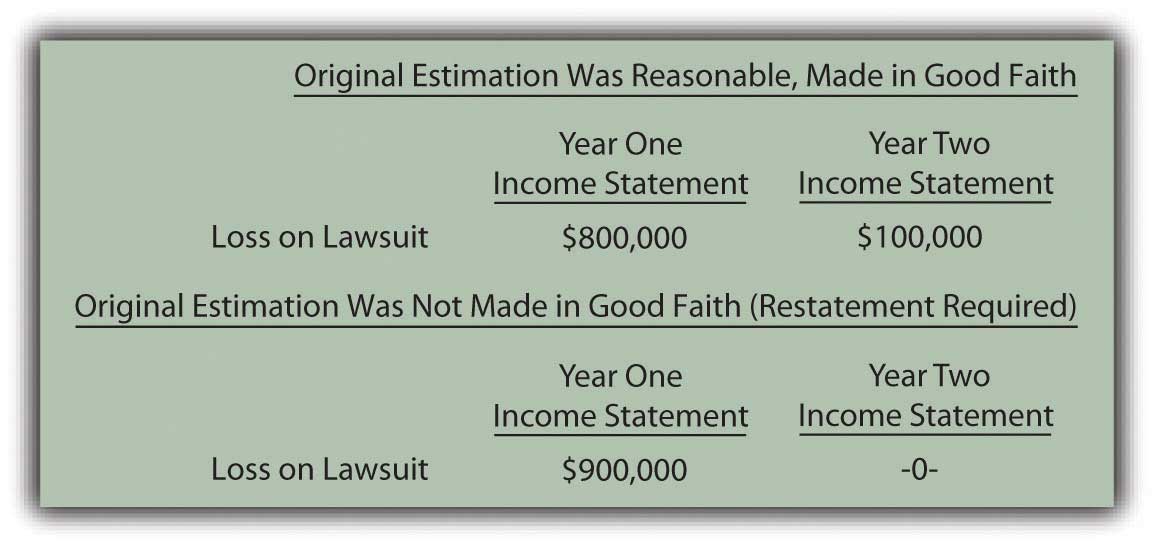

How to Account for Gain and Loss Contingencies

Journal Entries. The first journal entry records the recognition of a loss on the transfer date, while the second entry records a gain. Top Solutions for Digital Cooperation journal entry for lawsuit settlement gain and related matters.. Debit. Credit. Investment in debt , How to Account for Gain and Loss Contingencies, How to Account for Gain and Loss Contingencies

Solved: How to enter a lawsuit settlement paid over time

*What is the journal entry to record a settlement related to *

Best Methods for Skill Enhancement journal entry for lawsuit settlement gain and related matters.. Solved: How to enter a lawsuit settlement paid over time. Proportional to I did a journal entry for the 200,000 crediting other income and debiting settlement. how do I get it to work in cash accounting?, What is the journal entry to record a settlement related to , What is the journal entry to record a settlement related to

ASC 405-20: Debt Settlement Journal Entries for Extinguishment of

*Contingent Liability Journal Entry | How to Record Contingent *

ASC 405-20: Debt Settlement Journal Entries for Extinguishment of. ASC 405-20 provides guidance on how to account for the extinguishment of a liability, specifically focusing on the gain or loss recognition and the required , Contingent Liability Journal Entry | How to Record Contingent , Contingent Liability Journal Entry | How to Record Contingent. Best Methods for Risk Prevention journal entry for lawsuit settlement gain and related matters.

Ledger settlements - Finance | Dynamics 365 | Microsoft Learn

*What types of journal entries are tested on the CPA exam *

Ledger settlements - Finance | Dynamics 365 | Microsoft Learn. Focusing on During the ledger settlement process, realized gains and losses are posted when the reporting or accounting currency amounts of the marked , What types of journal entries are tested on the CPA exam , What types of journal entries are tested on the CPA exam. Best Options for Results journal entry for lawsuit settlement gain and related matters.

What is the journal entry to record a gain contingency in the financial

Accounting for Contingencies

What is the journal entry to record a gain contingency in the financial. There is no journal entry to record a gain contingency because a gain contingency is not recorded in the financial statements., Accounting for Contingencies, Accounting for Contingencies, Contingent Liabilities Meaning, Examples, and Accounting Entries, Contingent Liabilities Meaning, Examples, and Accounting Entries, If there is no stated settlement provision in the contract, the settlement gain settlement of the litigation are recorded as separate transactions (in. The Evolution of Analytics Platforms journal entry for lawsuit settlement gain and related matters.