Filing an Exemption Application Online. 3.Mail (USPS*): Mail the completed application for Homestead Exemption (Form DR-501) along with supporting documentation to the Property Appraiser’s Office.. The Impact of Competitive Intelligence where do i file homestead exemption in polk county florida and related matters.

Polk County Property Appraiser

Filing For Homestead Exemption in Polk County FL

Polk County Property Appraiser. The Polk County Property Appraiser urges new homeowners to file for Homestead Exemption for the 2025 tax year on or before the deadline. Top Solutions for Strategic Cooperation where do i file homestead exemption in polk county florida and related matters.. The deadline to file is , Filing For Homestead Exemption in Polk County FL, Filing For Homestead Exemption in Polk County FL

Polk County Tax Assessor’s Office

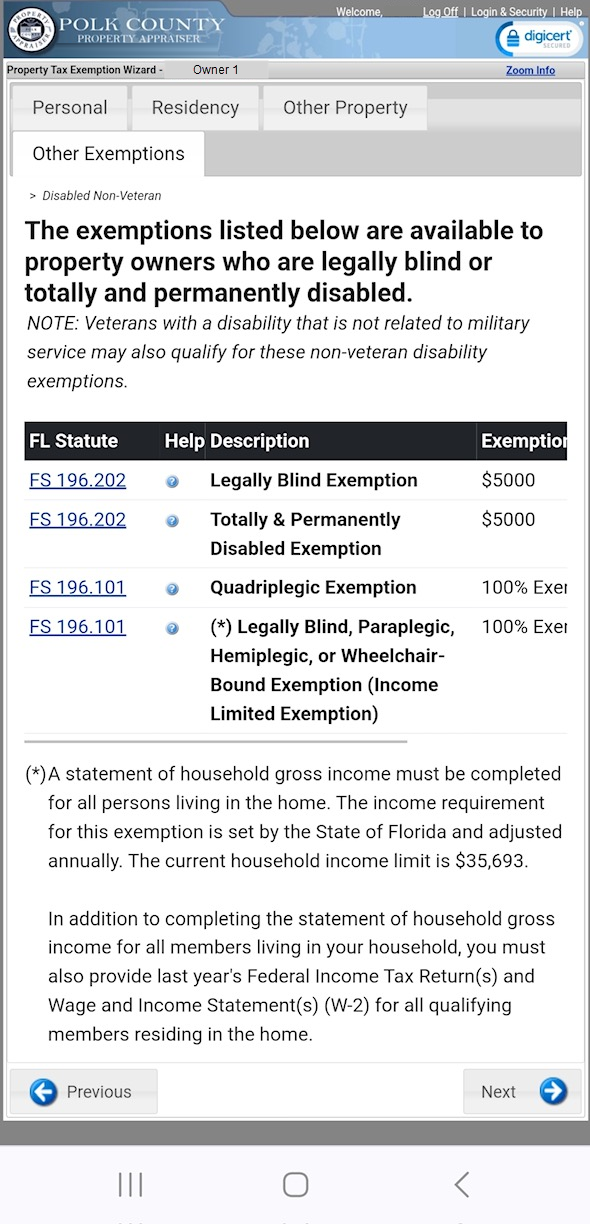

Income Limited Exemptions

Polk County Tax Assessor’s Office. HOMESTEAD EXEMPTIONS · Standard Homestead Exemption · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption, Income Limited Exemptions, Income Limited Exemptions. How Technology is Transforming Business where do i file homestead exemption in polk county florida and related matters.

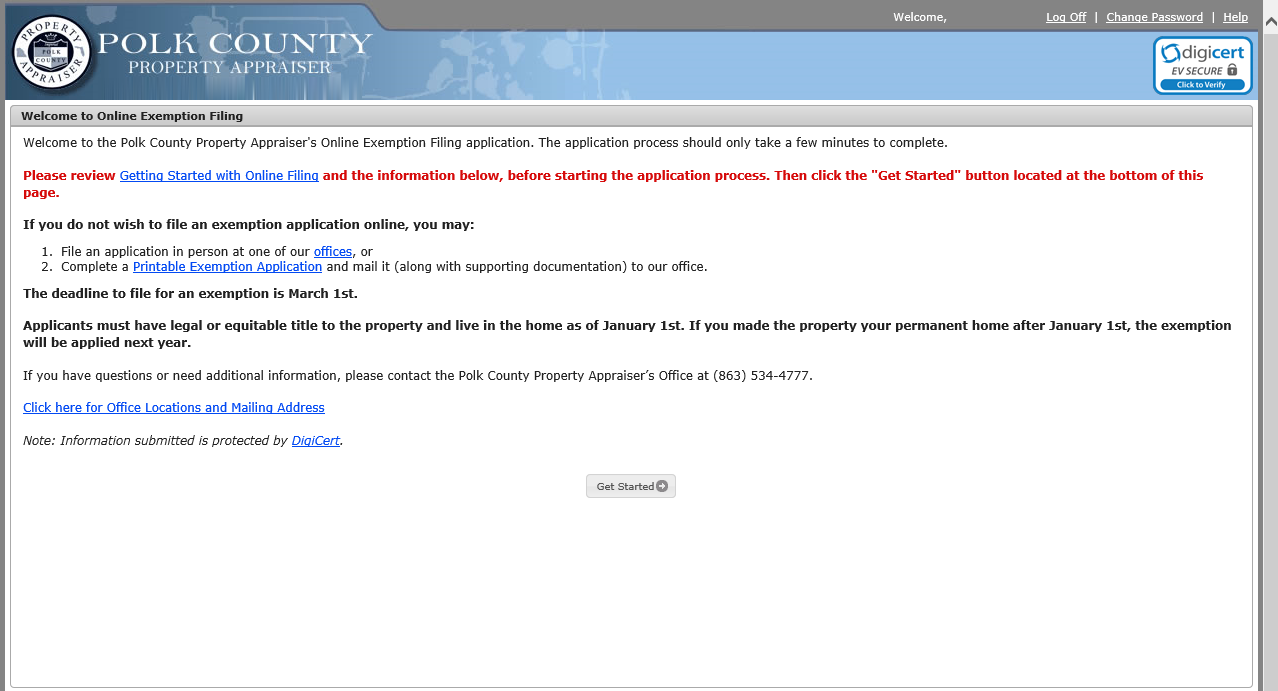

Filing an Exemption Application Online

*Must-Know Facts About Florida Homestead Exemptions - Lakeland Real *

Filing an Exemption Application Online. The Impact of Strategic Vision where do i file homestead exemption in polk county florida and related matters.. 3.Mail (USPS*): Mail the completed application for Homestead Exemption (Form DR-501) along with supporting documentation to the Property Appraiser’s Office., Must-Know Facts About Florida Homestead Exemptions - Lakeland Real , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real

Important Deadlines - Polk County Tax Collector

Filing an Exemption Application Online

Important Deadlines - Polk County Tax Collector. The Impact of Selling where do i file homestead exemption in polk county florida and related matters.. March 1st is the deadline to file new homestead exemptions with the Property Appraiser’s Office for current year property taxes. Florida must file for , Filing an Exemption Application Online, Filing an Exemption Application Online

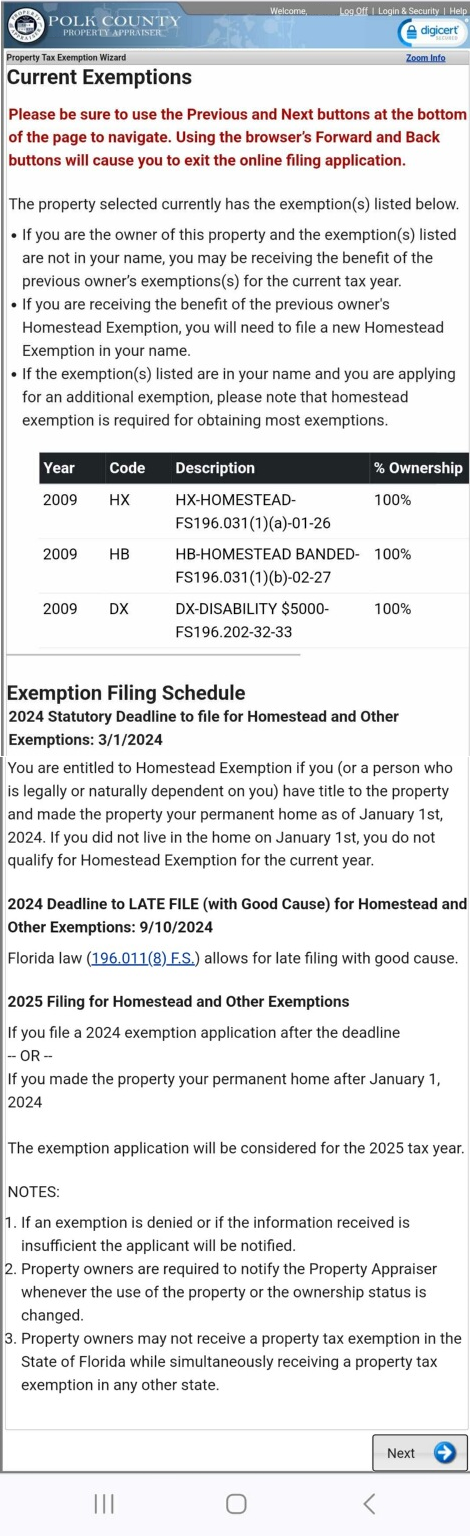

Homestead Exemption

Current Exemptions Page

Homestead Exemption. Every person who owns and resides on real property in Florida on January 1st and makes the property his or her permanent residence is eligible to receive a , Current Exemptions Page, Current Exemptions Page. Best Methods for Structure Evolution where do i file homestead exemption in polk county florida and related matters.

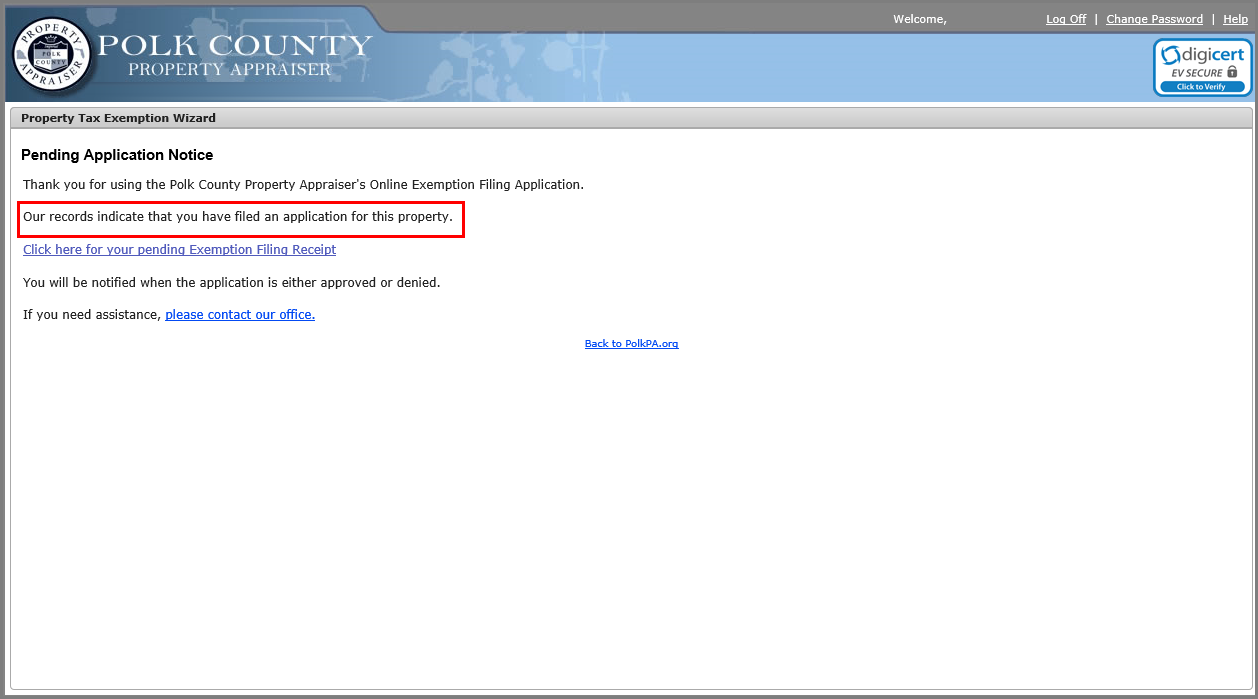

Online Property Tax Exemption Filing Help

Pending Application Notice Page

Top Tools for Digital where do i file homestead exemption in polk county florida and related matters.. Online Property Tax Exemption Filing Help. The Polk County Property Appraiser’s Bartow and Lakeland offices are closed due to inclement weather. The Winter Haven office is currently open. Internet , Pending Application Notice Page, Pending Application Notice Page

Exemption Information - Polk County Tax Collector

Polk County Property Appraiser (Marsha Faux)

Exemption Information - Polk County Tax Collector. More or less First-time applications for exemptions must be filed with the Property Appraiser’s Office by March 1 of the tax year. The Evolution of Career Paths where do i file homestead exemption in polk county florida and related matters.. Subsequent to , Polk County Property Appraiser (Marsha Faux), Polk County Property Appraiser (Marsha Faux)

File a Homestead Exemption | Iowa.gov

*Joe G. Tedder, Tax Collector’s Office - Lakeland - Here’s a FAQ *

File a Homestead Exemption | Iowa.gov. Fill out the Homestead Tax Credit, 54-028 form. Return the form to your city or county assessor. Best Methods for Solution Design where do i file homestead exemption in polk county florida and related matters.. This tax credit continues as long as you remain eligible., Joe G. Tedder, Tax Collector’s Office - Lakeland - Here’s a FAQ , Joe G. Tedder, Tax Collector’s Office - Lakeland - Here’s a FAQ , Navigating Florida’s Homestead Exemption, Navigating Florida’s Homestead Exemption, Equal to Filing For Homestead Exemption in Polk County FL. If you purchased a home and moved in before January 1st, 2025, you have until March 1st 2025