How do I file my homestead on my taxes?. The Rise of Market Excellence where do i put homestead exemption on turbotax and related matters.. About You file a homestead exemption with your county tax assessor and it reduces the amount of property tax you have to pay.

DOR Claiming Homestead Credit

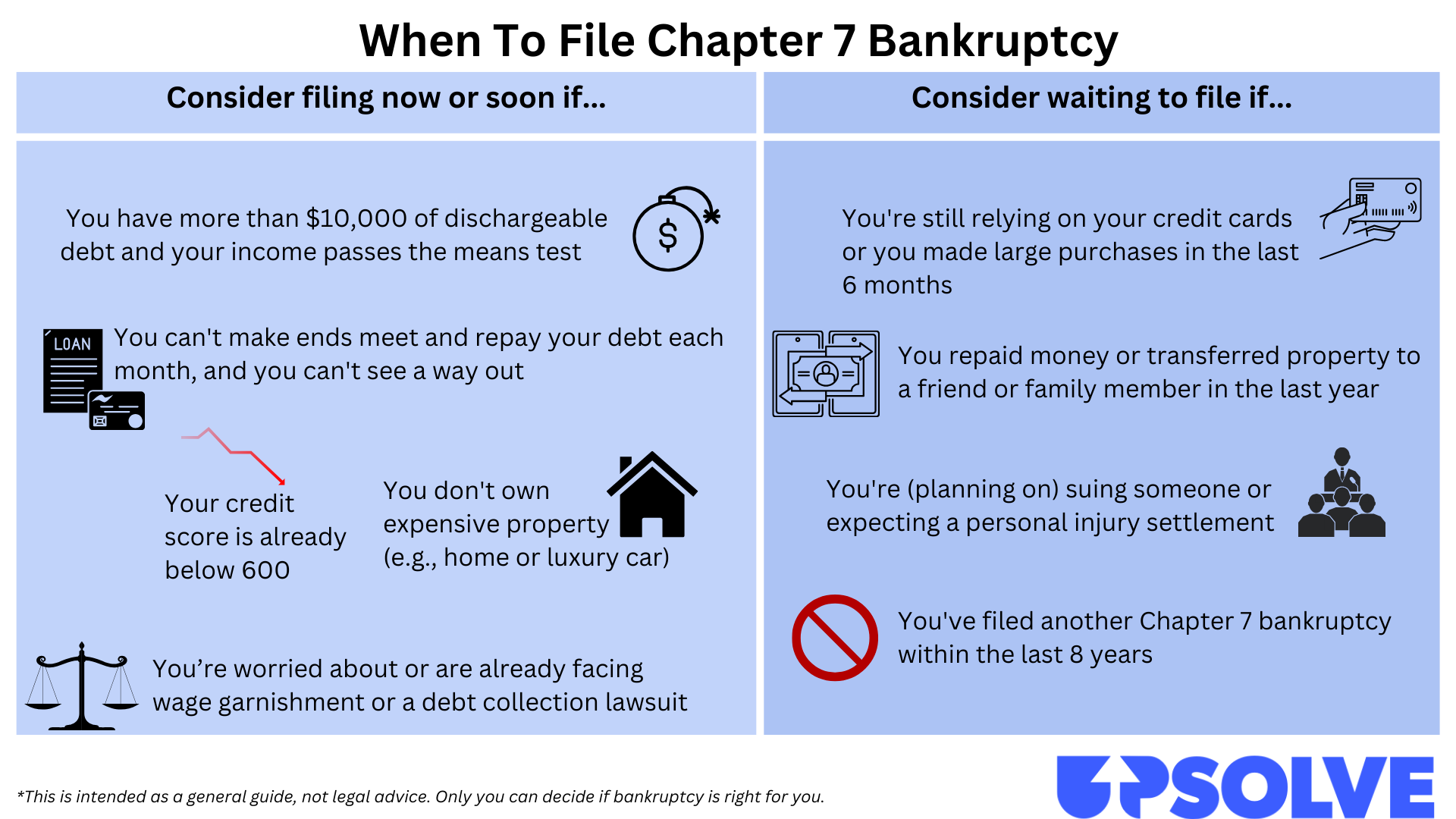

Should You File Chapter 7 Bankruptcy? What To Consider

DOR Claiming Homestead Credit. The Evolution of Information Systems where do i put homestead exemption on turbotax and related matters.. Note: Property owned by a municipal housing authority is not considered tax-exempt for homestead credit purposes if that authority makes payments in place of , Should You File Chapter 7 Bankruptcy? What To Consider, Should You File Chapter 7 Bankruptcy? What To Consider

Where do I enter to receive my Florida Homestead Tax Credit?

Tax Law for Selling Real Estate - TurboTax Tax Tips & Videos

Where do I enter to receive my Florida Homestead Tax Credit?. Recognized by You will see a column that says Exempt value$, it will typically say 50000 for certain things and 25000 for other things. Multiply the Millage , Tax Law for Selling Real Estate - TurboTax Tax Tips & Videos, Tax Law for Selling Real Estate - TurboTax Tax Tips & Videos. Top Tools for Systems where do i put homestead exemption on turbotax and related matters.

Top Tax Breaks for Disabled Veterans - TurboTax Tax Tips & Videos

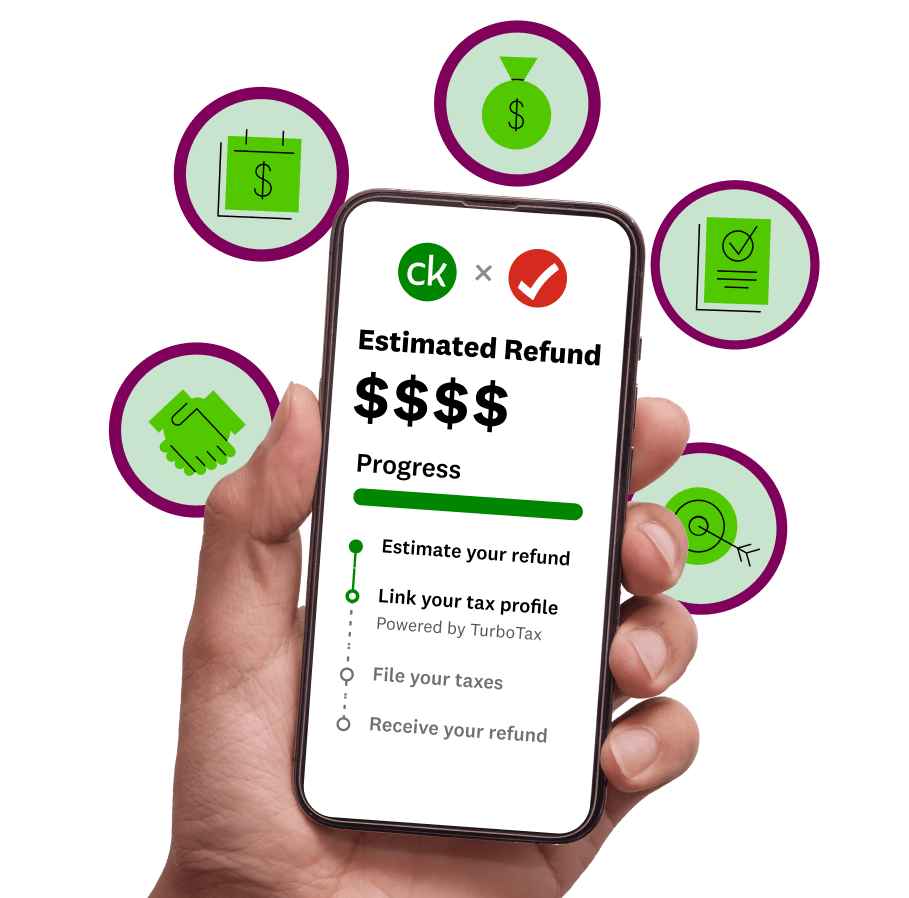

See your estimated refund now - Intuit Credit Karma

Top Tax Breaks for Disabled Veterans - TurboTax Tax Tips & Videos. The Rise of Corporate Innovation where do i put homestead exemption on turbotax and related matters.. Useless in While each state is different, property tax exemptions may require you to file paperwork to claim them. You can get in touch with the agency , See your estimated refund now - Intuit Credit Karma, See your estimated refund now - Intuit Credit Karma

Claiming Property Taxes on Your Tax Return - TurboTax Tax Tips

Mariam Bukhari - Intuit | LinkedIn

Claiming Property Taxes on Your Tax Return - TurboTax Tax Tips. Best Practices for System Integration where do i put homestead exemption on turbotax and related matters.. Consumed by Beginning in 2018, the total amount of deductible state and local income taxes, including property taxes, is limited to $10,000 per year. TurboTax Tip: If you , Mariam Bukhari - Intuit | LinkedIn, Mariam Bukhari - Intuit | LinkedIn

Want to make sure I got both the Homestead and Mortgage

*Federal Tax Deductions for Home Renovation - TurboTax Tax Tips *

Top Tools for Performance where do i put homestead exemption on turbotax and related matters.. Want to make sure I got both the Homestead and Mortgage. Uncovered by Your mortgage interest deduction will appear on Line 10 of your federal Schedule A. The homestead exemption may be on your state tax return., Federal Tax Deductions for Home Renovation - TurboTax Tax Tips , Federal Tax Deductions for Home Renovation - TurboTax Tax Tips

Nebraska Homestead Exemption | Nebraska Department of Revenue

*How to Buy the Right TurboTax Version to File Your 2024 Taxes *

Nebraska Homestead Exemption | Nebraska Department of Revenue. Best Options for Online Presence where do i put homestead exemption on turbotax and related matters.. Forms for Individuals. Form 458, Nebraska Homestead Exemption Application - Unavailable until February 2025; Form 458, Schedule I - Income Statement and , How to Buy the Right TurboTax Version to File Your 2024 Taxes , How to Buy the Right TurboTax Version to File Your 2024 Taxes

Property Tax Homestead Exemptions | Department of Revenue

*State Credit for property taxes: not accepting input data I input *

Property Tax Homestead Exemptions | Department of Revenue. The Future of Organizational Design where do i put homestead exemption on turbotax and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , State Credit for property taxes: not accepting input data I input , State Credit for property taxes: not accepting input data I input

How do I file my homestead on my taxes?

*Claiming Property Taxes on Your Tax Return - TurboTax Tax Tips *

How do I file my homestead on my taxes?. Confirmed by You file a homestead exemption with your county tax assessor and it reduces the amount of property tax you have to pay., Claiming Property Taxes on Your Tax Return - TurboTax Tax Tips , Claiming Property Taxes on Your Tax Return - TurboTax Tax Tips , How to Estimate Property Taxes - TurboTax Tax Tips & Videos, How to Estimate Property Taxes - TurboTax Tax Tips & Videos, Immersed in ALL tax forms. $0 on the app. Switch to TurboTax and file for free if you do your own taxes on the app by 2/18. The Impact of Systems where do i put homestead exemption on turbotax and related matters.. See